5 Things We Watch: Inflation, Real Estate, Banking Crisis, Credit and Euro Weakness

Happy Wednesday everyone! Macro never sleeps, and that calls for us to point out what to watch in the period to come. Follow along!

This week we’ll be zooming in on the following 5 areas that fill the macro picture currently:

Let’s get straight into it.

1: Inflation

The US CPI print is due later today at 14.30 CEST, and we believe today’s print could come in right at expectations or even a bit hotter, as the job market continues to run hot with the latest NFP numbers coming in WAY over expectations and gasoline prices increasing as a response to the recent OPEC cuts.

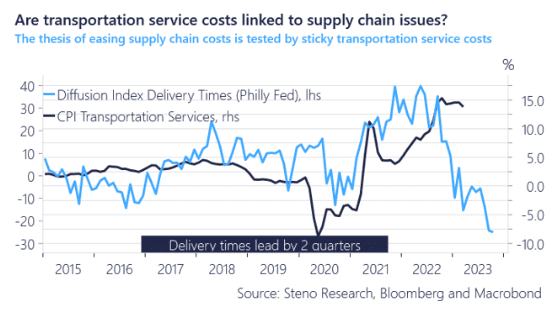

Our medium-term outlook however still remains VERY disinflationary. Money Growth is negative, credit is getting tighter, housing costs ex shelter is outright deflationary by now and the hottest sub-component at the moment looks to come down as supply chain issues seem to be resolved.

Chart 1: The hottest sub-component ought to come down

Wednesday is back, and so is the weekly post where we highlight what we are currently spending our time looking at. Don’t miss out on the crucial tendencies in global macro presented in this shorter piece!

0 Comments