Our Research

Steno Signals

Steno Signals is our weekly editorial on everything macroeconomic, written by Andreas Steno.

Daily Post

Something for your Espresso is your morning research letter from Steno Research preparing you for the day to come.

Emerging Markets

Emerging Markets delves into the most timely and relevant news and movements from and relevant to emerging markets.

The Great Game

The Great Game is our weekly editorial on geopolitics and global conflict.

Watch Series

Watch Series is a collection of individual series such as Europolitics Watch, Inflation Watch, Real Estate Watch, and much more.

Crypto Moves

Crypto Moves is our detailed editorial that explores topics relevant to the crypto market, helping you stay ready for future developments.

… and much more

We go even further, publishing research applicable to all markets and topics.

We Are A Passionate European Research Power House with a single Goal: To Position You for long-term success.

Located in the heart of Copenhagen, Denmark, our team is composed of brilliant thinkers with expansive expertise. Our domains range from the intricacies of macroeconomic landscapes to the nuances of geopolitical affairs, along with trading strategies and energy matters to digital assets and quantitative approaches. This comprehensive understanding shapes our market insights at your benefit.

Latest Notes

Portfolio Watch: Markets discarding Q2 data due to Dudley?

2024-07-26The market is hellbent on pricing in cuts, even when the data is hawkish. This is an interesting dynamic and the FOMC/BoJ meetings next week will be key to gauging ...Macro Nugget: US equity risk premium below 1%.. time to worry?

2024-07-26As the equity risk premium dips below 1%, nearing levels seen during the Global Financial Crisis, should we all start the fire sale?Central Bank Watch – We are approaching the point where the market is losing its composure

2024-07-25All it took for markets to unwind their macro-divergence trades was Powell confirming the beginning of a new cycle by hinting at a September rate cut in advance, coupled with ...

Latest Daily Post

Something for your Espresso: What recession? Is forward pricing ahead of itself again?

2024-07-26The US economy is not slowing down, and several central banks in the G10 are leaning towards hikes rather than cuts as we approach autumn. Is forward pricing in rates ...Something for your Espresso: The one on JPY, steepeners and position squaring

2024-07-25It seems like the JPY move has triggered a cross-asset position squaring, meaning you need to be aware of whether a trade is popular or not. Interestingly, the curve is ...Something for your Espresso: Here comes the JPY (and the sun)

2024-07-24The JPY is on the move ahead of the BoJ/FOMC policy meetings by month-end supported by rebalancing flows, softening real-rate spreads and a fading bid for debasement hedges. Will it ...

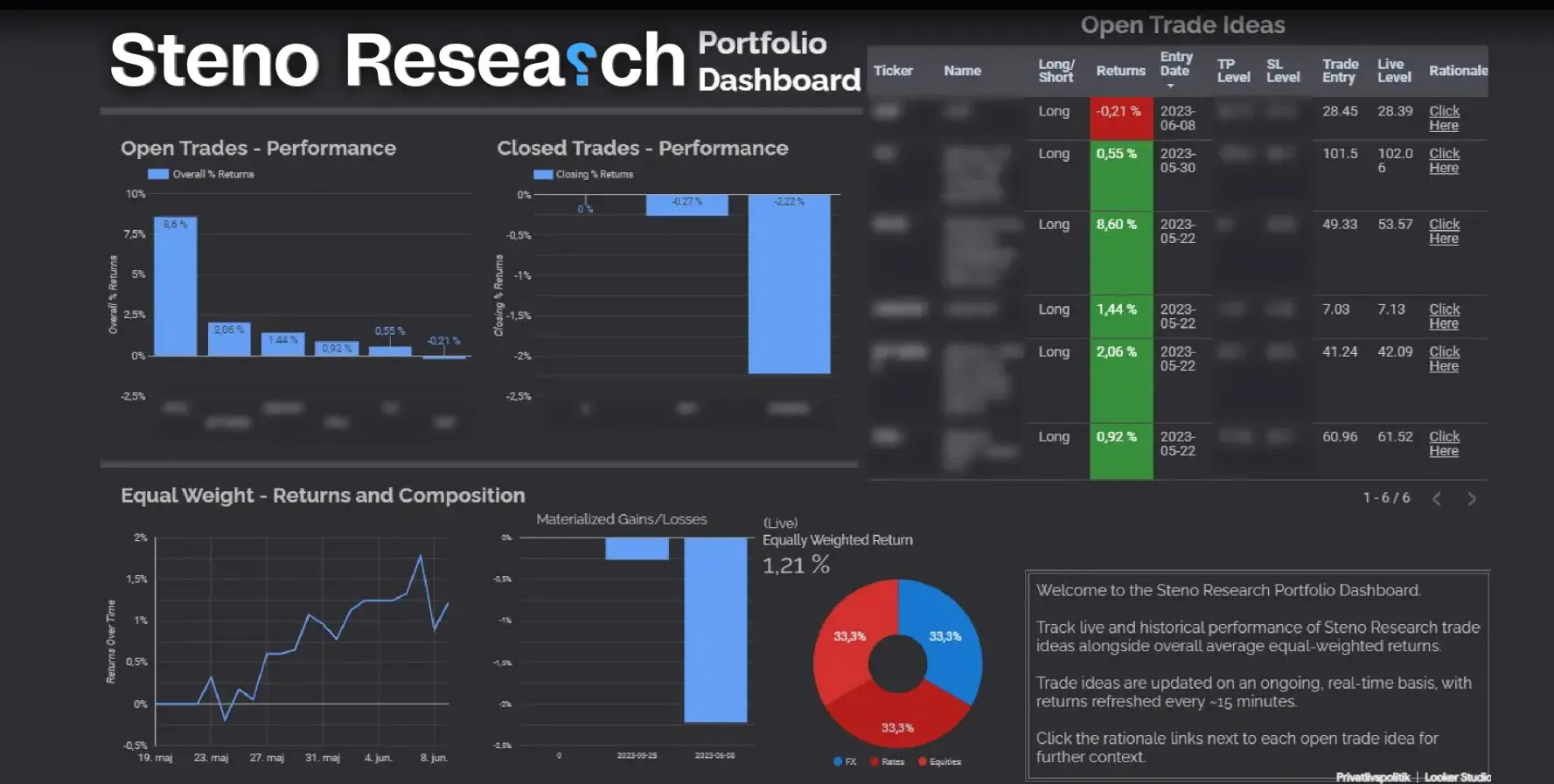

Always Actionable

Our mission is to pave the way for your success. Besides our written research, we achieve this by providing you with direct access to ‘Datahub,’ the very foundation of our proprietary research. Beyond that, our analysis readily converts into actionable trades, available within our Macro Portfolio. Additionally, you’ll discover crypto opportunities in our Crypto Portfolio.

“We are not afraid to publish research that is contrarian to public perception. In fact, we know this is what gives you an edge in the market.”

– Andreas Steno Larsen, Managing Partner

Get Ahead Of The Crowd

Equipped with our research and quantitative tools, you’re ahead of the crowd in every market, asset class, and financial environment.

Institutional Offering

Every day of the week, we provide research, bespoke services, and desk access to some of the world’s largest hedge funds and asset managers. Become a part of this elite group today.

Desk Access

By subscribing to our institutional offering, you gain direct access to our analysts in both written and spoken formats, whenever you see fit.

Wide-Ranging Coverage

We address all the topics and assets that matter to you, including macroeconomics, geopolitics, trading strategies, and digital assets.

Specialized Research and Reports

Our research extends well beyond the resources available on our website. We have the capabilities to provide you with insights on any topic you have in mind.

Bespoke Presentations

Not sure what to say? We’ve got you covered. We share our expertise through presentations at various events for clients around the globe.