Something for your Espresso: Peak EUR optimism and credit contraction confirmed?

Good morning, Friends!

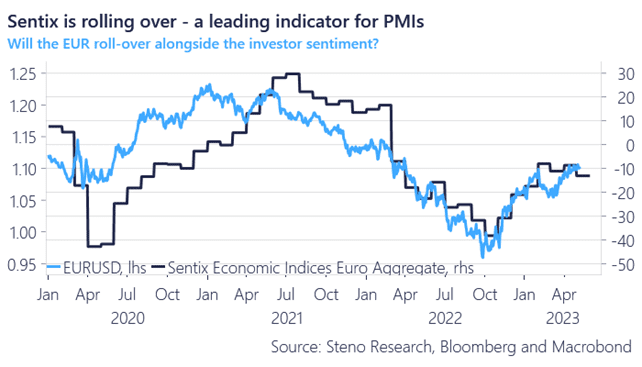

The Euro area rebound optimism, fueled by falling energy prices, is now evidently starting to roll over again as we have warned about in recent weeks. The sentix investor survey (a leading indicator for Euro area PMIs) dropped to -13.1, which hints of Sub-50 PMI levels over the next 2-3 months.

Sentix has also been a tremendous early warning signal for EURUSD in recent years and we find the roll-over of expectations noteworthy as the “fuel” from lower and lower energy prices since the late fall is fading from a momentum perspective.

We are comfortable with the recent added shorts in EUR/USD.

Find all the data on the Loan Officer Survey and the credit contraction below (14 days FREE trial).

Chart 1: The Euro area rebound optimism may be rolling over

Several indicators are starting to roll over in Europe, which may be at odds at with the current positioning in markets. Meanwhile, the loan officer survey continued to tighten, but not to alarming levels. The demand side of the credit equation is doing much worse than the supply side.

0 Comments