Macro Watch: The one on regulation, FDIC incentives and cutting cycles

This is another of my short and sweet editorials where I will unpack the following:

1) Why regulation is playing a part in the current crisis without solving it

2) Why FDIC incentivization of banks is now outright horrible

3) How severe a credit contraction we should expect and

4) Why I find a 200-250bp cutting cycle commencing soon to be needed to save the day

Upfront, our conviction in long T-bonds (2-3yr), a steeper curve in EURs (Z3-Z5) and a lower EUR/USD reading is increasing by the day.

Why regulation is playing a part in the current crisis without solving it

Two of the major pieces of legislation that were implemented post the GFC play a major part in the current banking crisis.

The Liquidity Coverage Ratio (LCR) is a regulatory requirement that requires banks to hold sufficient high-quality liquid assets (HQLA) to cover their expected net cash outflows over a 30-day stress period, but it was never able to stress the amount of outflows seen in the SVB or the FRC case.

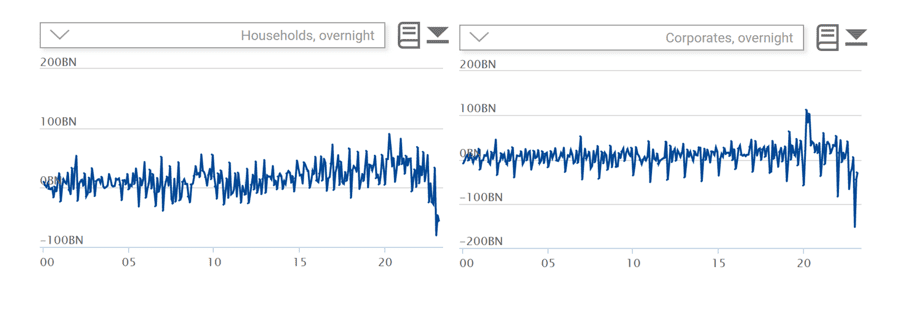

What’s more, there is no severe punishment for corporate deposits in the Basel III LCR framework, even if we can now empirically prove twice the speed of outflows of overnight deposits from corporates compared to households in Eurozone banks (and god knows how much more in the SVB case).

Solid LCR ratios are hence mostly thin air and do not pass a true reality test. The FDIC now suggests widening insurance for Corporate deposits, which is another example of regulation trying to fix existing bad regulation.

Find out more with a FREE 2-week trial.

Charts 1 and 2: Outflows of overnight deposits in European banks – households and corporates

The ECB and the Fed keep referring to sound and resilient conditions in banking as they obviously need to. Beneath the surface, a cocktail of mediocre regulation, bizarre incentives and complacent authorities is likely to guide us into a continued bank crisis until rates come down. Here is why!

0 Comments