Inflation chart book: Not as soft as we’d like but gone in 6 months

If you cannot show it in a chart, then it’s not true! Let’s dive right into our pamphlet on inflation indicators. You will soon be able to update yourself on our indicators daily in our datahub.

Markets expect headline inflation to print at 0.4% MoM (5% YoY) and core inflation to print at 0.3% MoM (5.5% YoY) – we don’t see a strong risk/reward in either direction of the consensus this month but consider an unchanged YoY pace of inflation unsatisfactory for the Fed and hence not news to buy bonds short-term.

Our medium-term (4-5 months) view remains VERY strong. Disinflation is happening faster than accepted by many.

What do surveys tell us about the inflation pace in 3-6 months from now?

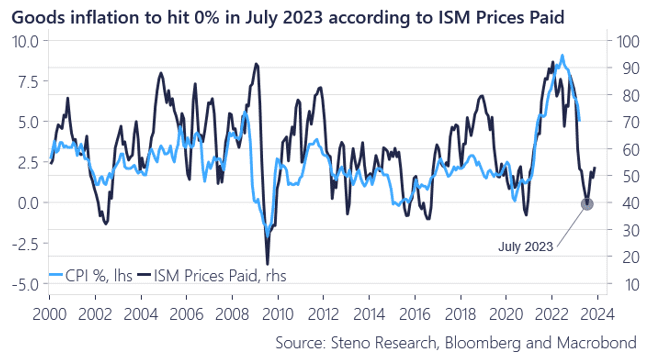

Goods inflation is likely to bottom around 0% in July before rebounding softly in the autumn.

Chart 1: Goods inflation at 0% in July?

There are reasons to believe that the April inflation report will not be as soft as we’d like, but our chart book of leading indicators continues to hint at a sharp disinflation over the next 3-5 months.

0 Comments