Real Estate Watch: More charts on the real estate outlook

Welcome back to yet another piece on US real estate, where we try to uncover how the outlook is looking, who the biggest losers are, and which banks who might be the next to suffer.

As mentioned plenty of times before, real estate is THE thing to watch when assessing the banking crisis which is back in business with JP Morgan purchasing First Republic (more on this here), as focus has shifted from deposits to the value of the underlying collateral behind loan-books (mortgages, MBS’ etc.). In this piece, we will try to expand our chart library on real estate by providing you with data on regional home prices, the current state of MBS’ and how commercial real estate is likely to remain a weak asset for banks. But first, let’s look at how our list of CRE heavy banks have performed since we last wrote about them.

Commercial real estate have not been a winning bet

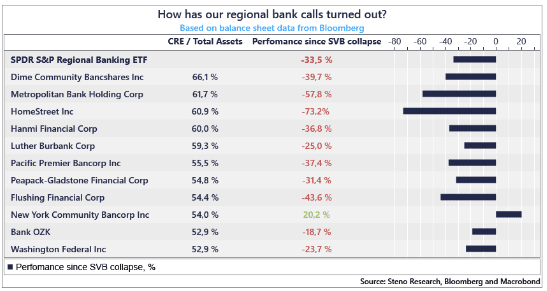

It’s safe to say that commercial real estate has not been a safe place to get a return. Not for investors, nor for banks. And the banks with the highest CRE exposure amongst the 200 banks in our homemade spreadsheet have certainly been sliced by the market. Dime Community Bancshares, Metropolitan Bank and Homestreet have all lost >30% in value since the SVB collapse, with Metropolitan Bank and Homestreet dropping 57,8% and 73,2% respectively, well above the SPDR Regional Banking ETF which have dropped 33,5% in the same period. So safe to say that we were on to something.

Chart 1: Regional banks with high CRE exposure continue to suffer

A couple of weeks ago, we provided you with a list of regional banks with the biggest exposure towards commercial real estate. Now, it’s time to see how those players have performed since, as well as providing you with further charts on the real estate outlook. Enjoy!

0 Comments