5 Things We Watch – Fed overtightening, Curve steepening, US CPI, BoJ & China

Welcome back to our Wednesday series where we take you through the world of global macro and what to look out for going forward. With US CPI being released tomorrow – where we as always will cover the most important take-aways post-release – there is room for market movements as the disinflation narrative continues amidst the possibility of a positive surprise in headline CPI due to base effects.

We’ll as always be short and concise and let you into our thinking regarding asset allocation and positioning ahead of the data/events mentioned.

This week we are watching out for the following 5 topics within global macro:

3) US CPI

4) BoJ

5) China

1) Fed Overtightening

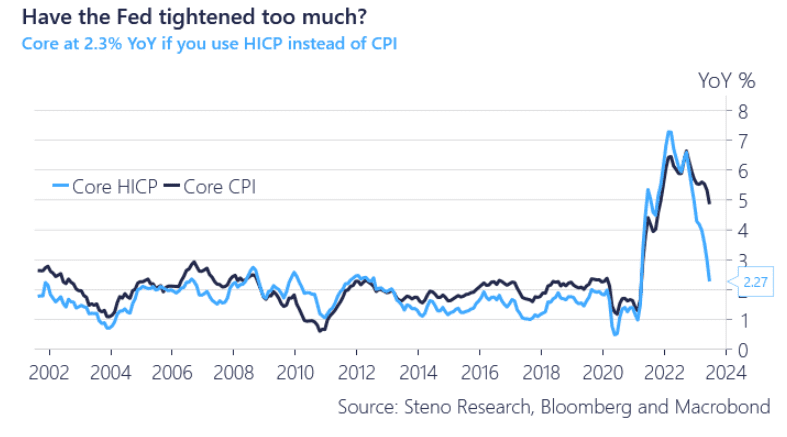

It’s no secret that the Fed and ECB use different methods to calculate the consumer price index, and until recently it has not really been worth mentioning as the difference between the European method (HICP) and the US method (CPI) have been negligible. But as one of the most sticky component in the basket – imputed rent – which is a part of CPI (with a weight of approx. 25%!) but not HICP, and using the latter tells a completely different story than the first – based on the HICP measure, core CPI is much closer to target than the official figure hints of.

This tells us 2 things: 1) The Fed might have tightened way too much, as they have based the hiking cycle on a figure that doesn’t represent the true economy (as shelter prices lag prices on other goods and services) and 2) that EZ HICP will get closer to target much faster as there is great evidence of future disinflation in non-shelter baskets.

Chart 1: We are very close to target already if we use HICP

Ahead of the CPI release tomorrow we zoom out to provide you with the bigger picture and what to watch out for in global macro over the next weeks.

0 Comments