Something for your Espresso: Shaky hands or cool composure?

Good morning from Europe

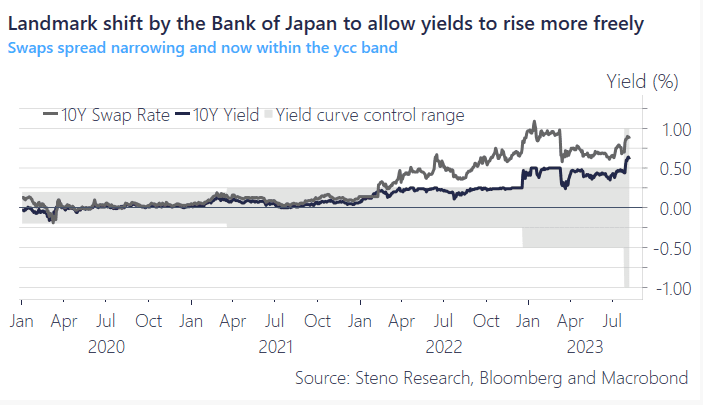

The past few days in the market have been quite eventful, largely influenced by the recent decision made by the Bank of Japan. There seems to be a growing sense of pessimism that has taken hold in the market, with interest rates experiencing increased demand and the stock market suffering significant losses.

Yesterday, one of our intelligent clients posed an intriguing question regarding the repatriation of funds. This query prompted me to delve deeper into the broader implications of the policy shift enacted by the Bank of Japan. It’s worth noting how this shift is impacting various aspects of the financial landscape. (I would really advise reading my esteemed colleague, Andreas’ piece on the immediate flow effects of the new policy regime- it has already aged like wine despite it only being a week old, see here)

To begin, it’s becoming increasingly clear that Ueda’s strategic approach to introducing greater flexibility into the policy regime has been quite astute. Despite initial expectations of significant volatility among speculators, the price action in Japanese Government Bonds (JGBs) has remained relatively subdued. The control over swaps has now been realigned within the and is anchored within the targeted range:

Chart 1: JGB 10’s and Swaps

Ueda has regained the upper hand in the game against the market but Equities are catching a bit of a cold. Meanwhile, we start to see dark clouds in the US economy and China is now officially in deflation

0 Comments