Yield Curve Watch: Bull, bear, steeper, flatter? Here is what the data suggests

Welcome to our Yield Curve Watch series.

Over the next few days, we will assess all asset classes in relation to the yield curve dynamics and back-test what works and what doesn’t work in various curve regimes.

As most of you have probably noticed by now, we see the steepening case as increasingly compelling from a macro perspective as (What a great day to write that with material bull-flattening across the board)

1) The issuance profile will move towards longer durations

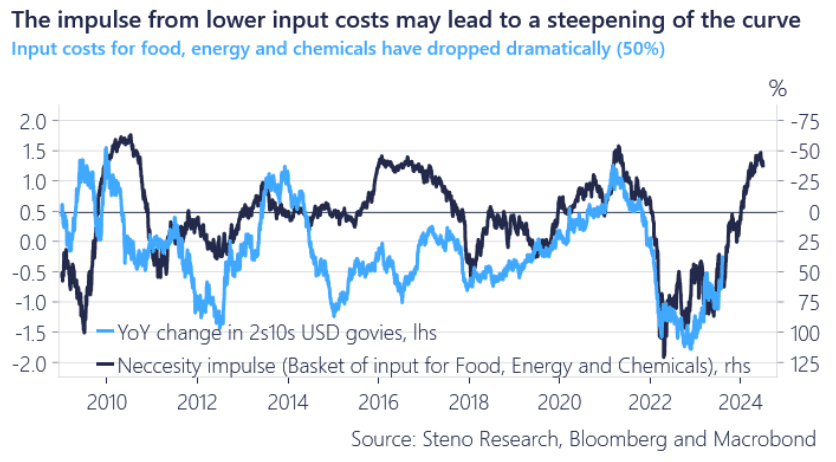

2) The Manufacturing rebound was driven by an input cost decline (see chart 1)

3) The BoJ decision has decreased Japanese incentives to buy USTs (see chart 2)

4) Positioning is already loaded with duration

5) Headline inflation will likely increase (bull market in commodities) paired with declining core inflation in annual terms

The flattener case will only continue to work if central banks re-accelerate the tightening cycle amidst falling core inflation, which we find unlikely given the recent signal sent by the Fed and the ECB.

Chart 1: Lower input costs -> rebound in Manufacturing -> Steeper curve

We launch our Yield Curve watch series with an editorial of the prospects for the curve. Is steepening on the cards? And is bull- or bear steepening most likely from here? Here is the data!

0 Comments