Inflation Watch – Here’s why EU inflation will get back to target faster than US inflation

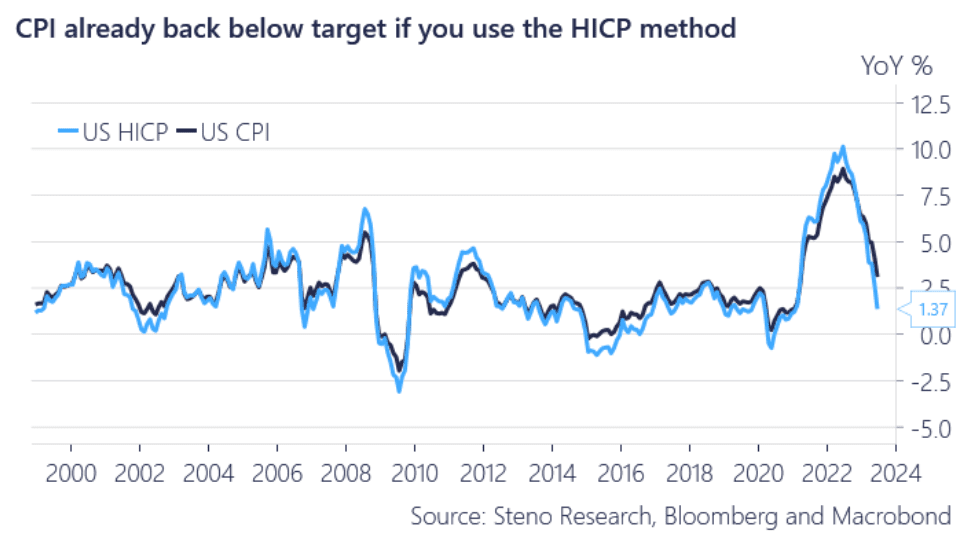

Lately, our attention has been directed towards analyzing the rate of inflation change on both sides of the Atlantic. However, a significant aspect that has been somewhat overlooked pertains to the composition of the inflation measures employed within the pertinent inflation indices. It’s worth noting that inflation indices aren’t an entirely objective construct; rather it is subject to discretionary weightings regarding measurement and the assignment of weights to various components.

Given this fact, we find it essential to raise the query of what the inflation landscape would resemble if we were to interchange the methodologies used in these regions. We’ve undertaken an examination of this matter by applying European HICP to the US and we think it offer some interesting insights:

Firstly, let’s quickly gaze on how US inflation would look if we used the European HICP methodology:

Chart 1: Inflation at 1.4% if you use HICP methodology

In this short note we go through why EU inflation is likely to get back to target faster than US inflation due to technical differences in the way of measuring inflation.

0 Comments