5 Things We Watch – The Equity Rally, the Chinese consumption problem, Consumers vs Corporates, 20/21 reversed?, MBS and the Fed

Happy Wednesday, and welcome back to our weekly ‘5 Things We Watch’ where we take you through some of the topics and events that we are looking out for currently.

With Fed minutes coming in later today, volatile markets should be expected, and the reversal of the recent rally is definitely in the cards depending on the hawkishness of the release. Markets are in general pricing in a soft landing with a strong job market and waning inflation, but Powell may put a stop to this later. One must remember that wealth effects play a decent role in consumption trends, and higher equity prices thus keep inflation more sticky down the line. No matter the outcome we’ll keep an eye out for the statement and what implications it has for markets.

Read along below to see what topics we are also tracking in the weeks to come.

This week we are watching out for the following 5 topics within global macro:

- The Equity Rally

- The Chinese consumption problem

- Consumers vs Corporates (Article coming soon)

- 20/21 reversed?

- MBS and the Fed

1) The Equity Rally

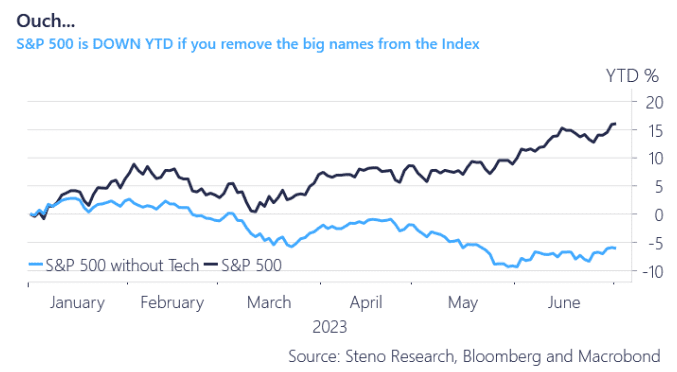

That equities have rallied extensively YTD is not up for debate, with S&P 500 up approximately 15% so far and Nasdaq running on a 30% YTD return, driven by the AI bonanza and promising liquidity trends. But how far will it continue? It seems like the markets are currently blowing off the recession, and who would blame people for going long when the job market is running hot with inflation coming down? The perfect cocktail for a melt-up in equities.

But – and there is a big but – when the rally is solely driven by 5-10 companies, it WILL be a problem if those companies stop performing. If you were to remove such companies from the S&P 500, the index would be DOWN approx. 5% YTD due to the weighting system (where weights are based on market cap).

We have been running the AI train for a while, but we are constantly assessing when to close the trade. You can as always follow what we do and when we do it in our live portfolio.

Chart 1: S&P 500 Returns are down YTD without Tech

The equity rally continues, Xi is in the middle of structural issues, house lending is falling off a cliff in EZ and inflation is waning fast. Read more about the 5 things that we watch currently in this week’s edition of ‘5 Things We Watch’.

0 Comments