Outside the Box #10 What if China favors bridges over credit cards once more?

Main points:

CCP is in a tough place and is forced to balance between long-term policy goals and short-term costs

The CCP could be incentivized to back investment (as per usual) despite rhetoric suggesting a policy pivot. This could lead to further tensions with Washington

There is not much pointing to a comeback for the Yuan no matter what policy path Beijing chooses

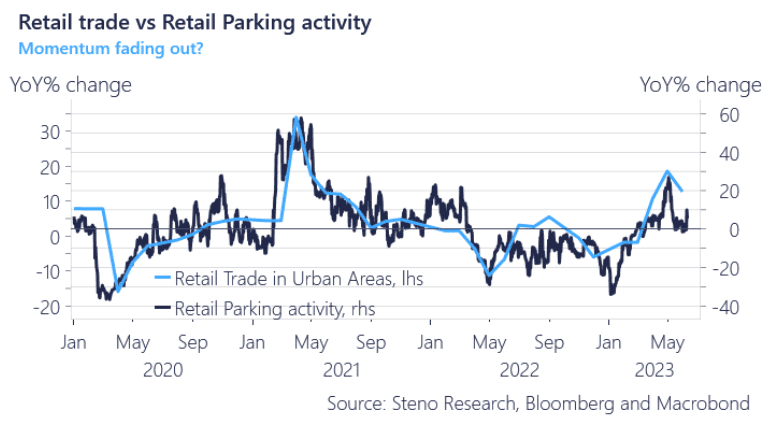

The Q1 reopening trade in China has fizzled and the CSI 300 now finds itself back to square from the New Year. The effects of the COVID-19 pandemic are still apparent, with a noticeable pattern of service sector expansion driven by pent-up retail demand, while manufacturing growth remains sluggish. Base effects are waning for this chart but Chinese consumers remain (somewhat) on the loose:

Chart 1: Retail trade vs Retail Parking activity

Subscribe to Premium to access the whole piece AND our Live Portfolio- 14-day trial below FOR FREE!

The West sent checks, while China focused on supply-side policies in response to Covid. But what will Beijing do now?

0 Comments