Out of the box #11 – Sticky is the new transitory

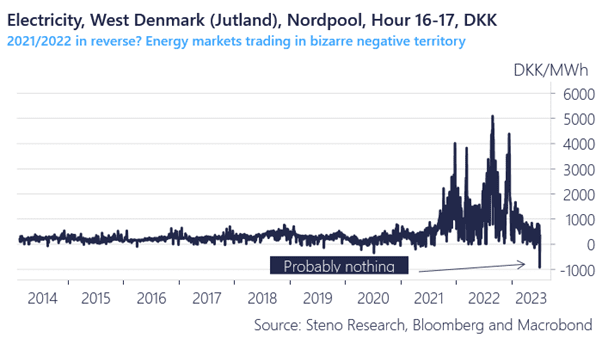

I woke up yesterday to a message from my power company that I would be paid to consume electricity. The peak hours 4-5 pm were priced at -1000 DKK/MWh in West Denmark and close to -1900 EUR/MWh just south of the border in Germany. These are unprecedented price levels and complete uncharted territory for electricity prices.

The vanilla takeaway is to shrug this off as a weather-related one-off with an extraordinary combination of wind and sun during a weekend, leaving Power-companies no choice but to pay the consumer to consume, but this was the exact same thing that initially happened in 2021 and early 2022 just in reverse.

Remember the stories of a weak wind season in Europe paired with a drought in Norway? This was used as an excuse for high energy prices in 2021. It sounds an awful lot like today in reverse and we all know how it all ended in 2022.

Chart 1: Nothing to see here in Danish electricity prices

The sudden occurrence of weird microcosms of extreme inflation in 2021 coincided with the extreme increase in the broad supply of EURs and now we suddenly see the first signs of weird microcosms of deflation while the broad supply of money is shrinking?

Is it a complete coincidence or is something more structural brewing beneath the surface?

We observe an increasing amount of weird microcosm deflation studies in Europe. So far, negative prices in Energy have been shrugged off due to “extraordinary circumstances”. Is this the “transitory” discussion of 2021/2022 in reverse?

0 Comments