5 Things We Watch – Fed, ECB, BoJ, RBA & Credit

It’s central bank week again! Always a busy week when the biggest central banks publish their monthly interest rate decisions, but as always we are on our toes to provide you with actionable and timely coverage of all the rate decisions, meeting takeaways and more from Fed, ECB, BoJ & the rest.

Our main thesis is that the overall message across the board will be slightly dovish given recent CPI numbers which suggest that the central banks’ job is done and that inflation will come down fast. But maybe central banks keep looking in the rearview mirror, afraid to make a mistake that will ignite inflation again.

Follow along, as we take a closer look at the 4 central banks reporting this or next week, as well as the newly released ECB lending survey, which suggests that the credit contraction is getting to Europe sooner rather than later.

This week we are watching out for the following 5 topics within global macro:

1) Fed

The Fed is the first in the line to report, and the decision – and most importantly the following press conference – will likely set the tone for markets in the days to come. The latest CPI report has pause written all over it after surprising to the downside, suggesting that the Fed’s job is done. Markets are pricing a 97% probability of a 25 bps hike later today, which is expected given the latest press conference, but it’s starting to look like the Fed will tighten too much. Does the Fed really want something to break to ensure that inflation will come down?

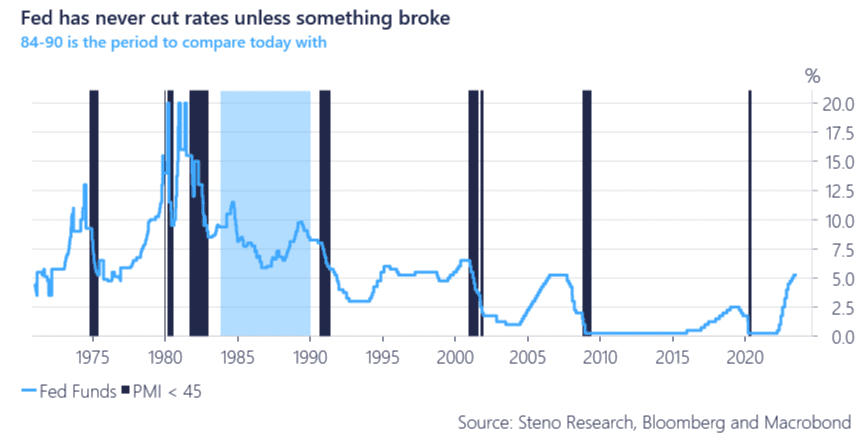

Looking at the historical evidence, the Fed has only cut interest rates in a high growth / strong labor market environment once before and normally waits to cut interest rates until the economy screams for it. Will this time be like in the 80’s? Or will the Fed stay hawkish until something breaks in the fear that inflation will reignite? A pause is in the cards, but what about cutting?

Chart 1: Will the cutting cycle first begin when things break?

It’s central bank week again, and that of course means that we provide you with all you need to know ahead of the big meetings. Recent inflation numbers have pause written all over it, but will central bankers keep their hawkish tone?

0 Comments