Trade Alert: Time to go down (under)!

We see value in betting on the AUD given our view on 1) the manufacturing cycle, 2) Chinese stimulus hopes (underpriced, but very hard to time) and 3) idiosyncratic AUD related reasons

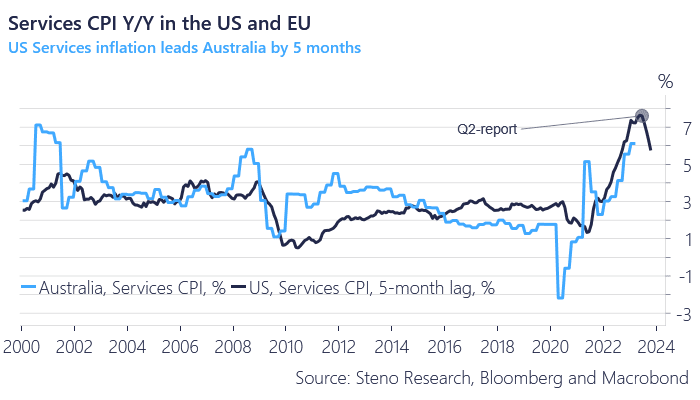

First, the Q2 inflation report in Australia, which will be released overnight (European hours), will likely prove to be smoking hot in the Services CPI component as the Australian cycle lags that of other anglo-saxon regions. The Q2 report will likely mark the peak in services inflation down under, but be enough to prompt speculation whether the RBA paused too early.

See how we implement the trade with a 14-day trial below.

Chart 1: Service inflation in the US versus Australia

We add to our cyclical bets in FX space with a few idiosyncratic reasons for this position as well.

0 Comments