Credit Watch: The credit contraction has arrived… 5 charts from the ECB credit survey

Here is a list of our top charts from the Q3 ECB Credit Survey. Just a few charts with a few words attached to them. The credit contraction is already a reality in Europe, but there are also signs of green shoots in the survey.

Key-take-aways

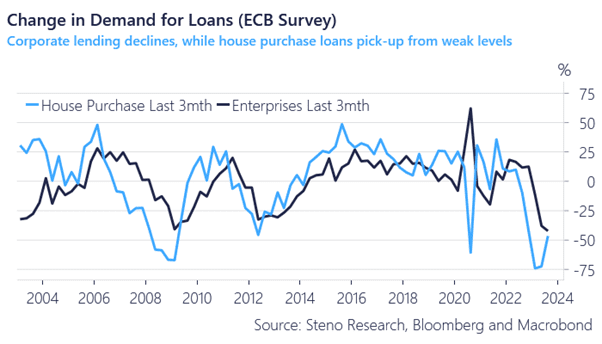

– Demand is weakening for corporate credit but stabilizing for house purchase credit

– Expectations for future demand have risen across categories

– The survey is consistent with a material credit contraction, but less bad than seen through Q2/Q3 so far

– Banks are getting increasingly worried about non-performing-loans but from low levels

– Credit standards are on a path towards easier terms into 2024 – and they are easier than in the US

Highlight 1: Demand

The demand for Credit declines further among corporates, while fewer banks report weakening demand for credit for household purchases. Remember that the rate of change is what matters most here.

Chart 1: Demand for credit over the past 3 months

The credit contraction is already a reality in Europe and the Q3 ECB Credit Survey confirmed that a contraction is the most likely scenario for H2-2023. There are early signs of improvement, which means that we may get an outright rebound into 2024.

0 Comments