Positioning Watch – The market’s response to another Fed hike

Happy Saturday, and welcome back to our weekly positioning article, where we as always take you through the positioning data that we have found relevant throughout the week.

The central bank week is over, and what a week it has been with the quite shocking decision from BoJ yesterday, moving the YCC upper band from 0.5% to 1%, increasing the flexibility of their monetary policy since they effectively now have more room to play with, and they don’t have to buy as many bonds as they do now to keep yields under control – unless yields rise to >1%.

In the West, the Fed and ECB delivered right as expected with a 25 bps hike each, despite inflation coming down FAST both in the US and EZ – it sure looks like they want to be sure that inflation gets down to target. The thing to watch from now on will be the time of pausing, with the ECB being more likely to keep rates steady earlier due to the inflation dynamics in the EZ – inflation will drop much faster in the EZ compared to the US in our opinion due to energy prices and base effects in the US.

As always, we’ll dissect handpicked soft data and add some hard data from CFTC on top to give you the best taste of how investors, traders, and we are positioned currently. Remember that you can always find our positions and how we are trading in our portfolio right here.

Without further ado, let’s get straight to our short and sweet overview.

Equity Positioning

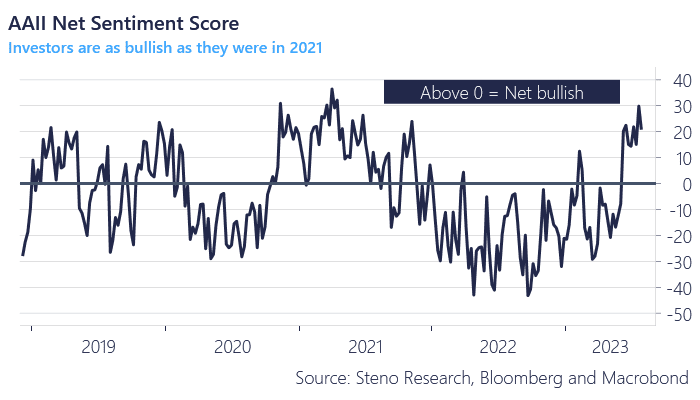

- Equity positioning remains extremely bullish with every single index on earth pushing for higher highs despite darker clouds emerging above European equity markets. AAII’s net sentiment score (Bullish Score – Bearish Score) is at the highs of 2021 – despite retracing a bit after the FOMC meeting – and CNN’s fear and greed index has been pushed into “Extreme Greed” now.

- The big question is still whether this is one of the biggest bear market rallies in history or a new bull market. It’s at least hated by many, as PMs have been caught on the wrong side of the market at the beginning of 2023, forcing them into the market now to catch up on the missed returns.

- Based on weekly ETF fund flows, there is not much to be seen. No unusual moves, and so it seems like investors are slowly increasing their long positions as there is currently no trigger event to turn the rally.Chart 1: Individual Investors are almost as bullish as 2021

The central bank week is over, and that means it’s time for us to have a look at how Investors and Traders perceived the Fed meeting and how they have adjusted their portfolios in response.

0 Comments