ECB Watch: Damned if you do & doomed if you don’t?

As avid readers of our research will know we have been very skeptical of the situation in Europe and how safe the market has treated our own homeland these past months.

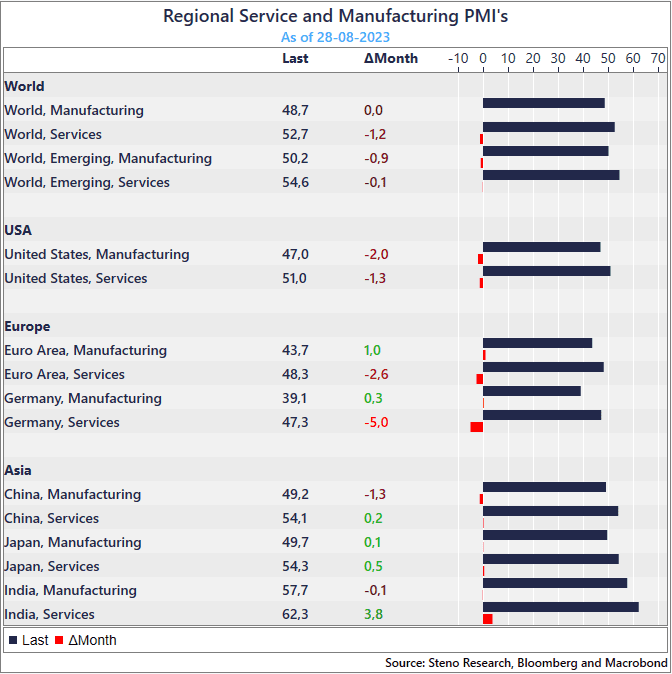

When we zoom out and look at the current prints it is rather explicit that the Eurozone is falling behind on a relative basis:

The severe energy supply shock, particularly pronounced in Europe (as detailed in my previous discussion on the topic), has been driving up costs. At the same time, real incomes continue to be eroded due to inflationary pressures.

These concurrent trends are unfolding against the backdrop of reduced goods demand, a consequence of the COVID-19 pandemic, and the ongoing challenges faced by capital-intensive manufacturing sectors.

We had previously anticipated manufacturing bottom to establish this month and projected that the services sector would begin to experience more significant setbacks.

And here we are:

Chart 1: PMI’s

We have argued that risks of a more rapid disinflation in Europe are going under the radar. But as we get poor job opening numbers from the US, how do we assess the growth trajectory of the EZ and how will the ECB likely act?

0 Comments