5 Things We Watch: The return of the banking crisis, Japan, China, Liquidity and Euro Inflation

It is Wednesday (once again), and as usual that means that we zoom out and highlight the 5 things that we believe are a MUST to watch in order to understand the global macro picture. As always we’ll be concise, equipping you with the best knowledge to understand the macro scene. The below listed are extracts from the content sent out to our premium clients – consider signing up and joining the fastly growing Steno Community. Sign up for a 14 day free trial here – you won’t regret it.

This week, we’ll take a look at the following 5 key topics captivating macro:

- The banking crisis is returning (Something for your Espresso)

- The pressure is on for Ueda (Japan Watch)

- China is not as solid as it might look (EM by EM)

- Liquidity is drying up (Money Watch)

- EZ inflation will likely come down… fast (Inflation Watch)

#1 The banking crisis is returning (Long Large Cap banks vs. Regionals)

Apparently the banking crisis is NOT over yet. First Republic Bank dropped another 50% in yesterday’s trading session as it was revealed that the bank has registered substantial deposit outflows during the last quarter (40% outflow). But was it just the odd one out? We don’t think so.

We keep getting questions on the deposit flight and we still find an overwhelming majority blaming it on money for fleeing for money market funds. Remember that a USD or EUR moved to a money market fund, will most likely end up at a deposit in the banking system again as the money market fund will buy a T-bill from another entity with a deposit in the commercial banking system.

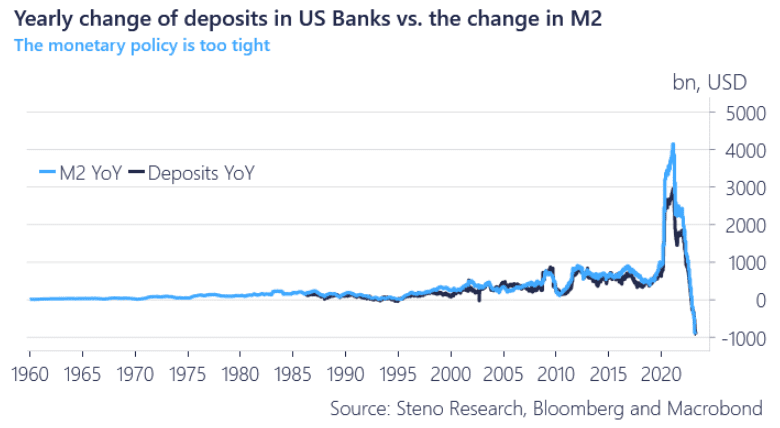

The true root cause of the deposit flight is the decline in M2 in circulation – i.e. monetary policy. Until the Fed and the ECB acknowledges that monetary policy is already too tight, we will continue to get negative news out of the banking sector in coming months and the upcoming credit contraction is likely to worsen consequently.

And with the recent stinker of an M2 number, it doesn’t look like it ends here.

Chart 1: The true root cause of the deposit flight is monetary policy

The banking crisis seems to be back, Asia is apparently the new black, and the hopes of an economic comeback in the West is vanishing. Things are certainly not as we thought a couple of months ago, but follow along as we look at the best hideouts in this week’s edition.

0 Comments