Inflation Watch: A short-lived acquaintance, or in the Euro Zone to stay?

Welcome to this chart-jammed but text-lean edition of the ‘Inflation Watch’, in which we’ll have a look at timely indicators on European inflation. We’ll assess what our data is showing and just briefly highlight what catches our eye – most of you are probably here for the charts anyway.

Table of contents:

- The latest report – An overview

- Data in favor of diminishing inflation

- Data showing stickier tendencies

- Market pricing

Without further ado, let’s get to it.

The latest report – An overview

With both France, Spain, and Germany publishing CPI-prints Friday, let’s just have a rundown of the latest Euro Area HICP available, as the three weigh heavily on the aggregate and usually (particularly Spain) act as bellwethers for what’s to expect for Europe broadly.

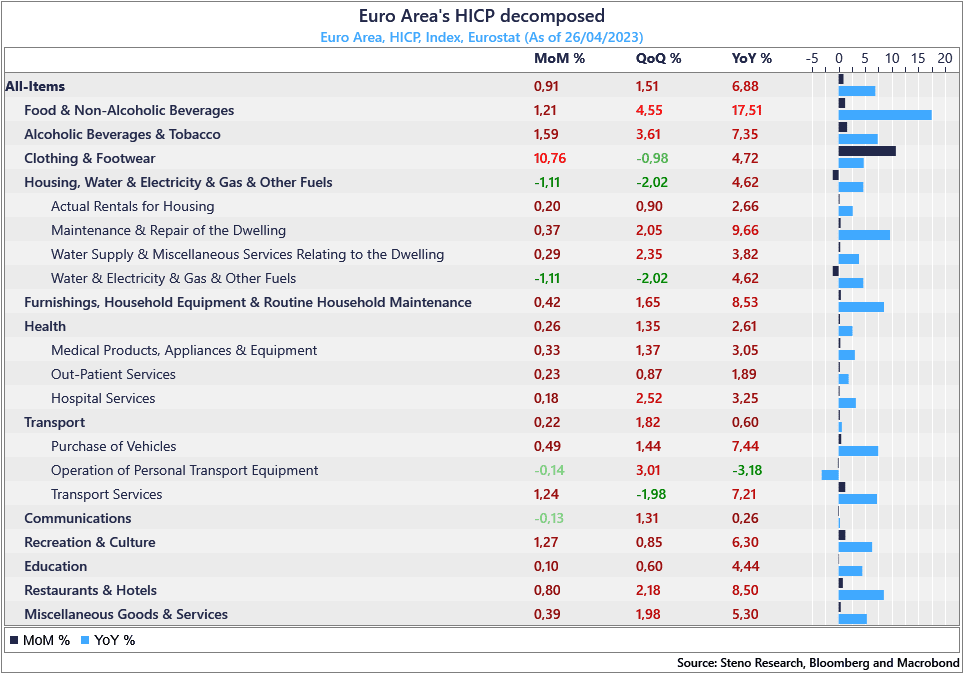

The price increases in food and beverages are not easily reversed – rather on the contrary – and this element in the basket is particularly constraining consumers’ spending (up 17,5% YoY). On a positive note, we saw outright deflation in utilities and energy both MoM and QoQ.

Chart 1: Euro Area HICP decomposed

The term inflation has merged from academia to layman’s vocabulary. The question is whether it’s time to shelf the term or if it remains as relevant as ever. We look at forward-looking indicators and try to pass judgment – this time on Europe.

0 Comments