Money Watch: Your favorite liquidity proxy is about to become drier than a Martini

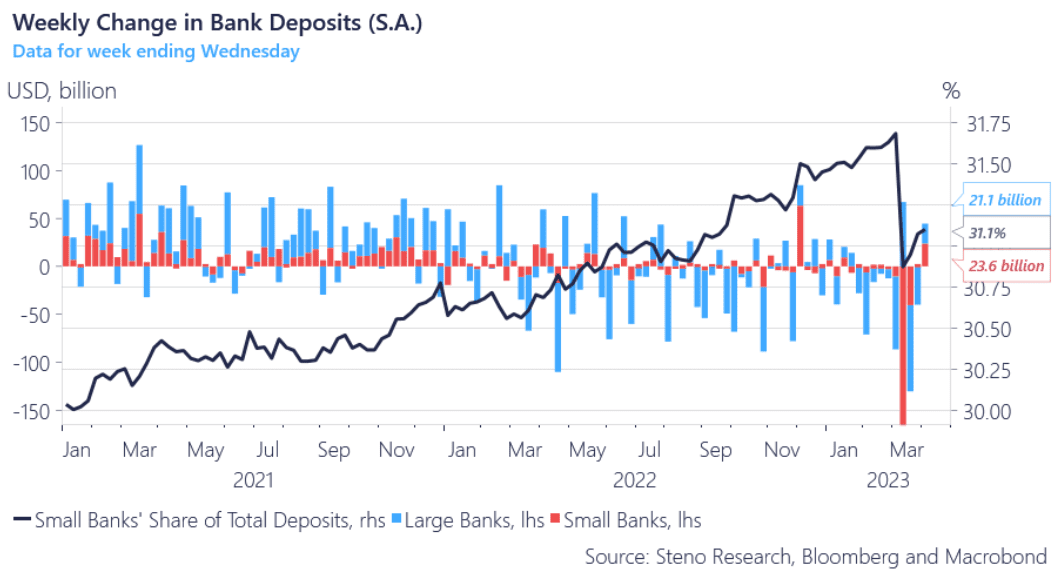

Last week we looked at deposit inflows coming from smaller banks into larger ones as a consequence of their ‘Too big to fail’ status during last month’s distress at SVB et al. The below chart is a good illustration of the mechanics at play and when you combine this with the big banks’ ability to create their ‘own’ yield curve you get an increase in earnings at the big banks as we expected last week. Meanwhile, the storm has calmed down a bit and the small banks’ share of total deposits has gained a bit in recent weeks. However, if fixed income losses continue its grind lower then we cannot rule out more stories of banks in trouble, though for now, it would seem the FED intervention has calmed the storm. Even still, losses on treasury and agency securities at all commercial banks securities have climbed below -10% y/y and that means we are in GFC territory on that front…

We also see that the …

The banking-storm has calmed down a bit and the small banks’ share of total deposits has regained some territory in recent weeks. However, if fixed income losses continue to weigh down on balance sheets, then we cannot rule out more stories of banks in trouble. For now though, it would seem the FED intervention has idled the turmoil.

0 Comments