EM by EM #8 The Indian elephant in the room- will it keep holding up?

In this analysis from last year, I explored the Asian geopolitical landscape and questioned how it will look in the post-Ukraine war world. I highlighted the possibility of Russia’s weakening becoming India’s strategic gain and argued why adversely this could lead to more tensions with China.

I argued that the convergence of Western supply lines seeking alternative destinations to China and India’s significant economic potential, characterized by its vast, growing, and cost-effective labor resource, presents a challenge to the CCP’s economic model- a threat that Beijing would likely attempt to undermine. (If you wanna check out how the fundamentals in demographics, trade and other key markers yourself – I would advise you to explore our new Data hub right here)

In March, the Economist followed up and coined the term “Altasia” for the rest of the suitors in the East Asian region wanting a piece of the potential capital exodus from China.

There is little doubt that the winners may be many but unlike Cambodja and other worthy candidates, India has strategic leverage due to its geopolitical importance. The West seeking a trade substitute could too find a reliable regional ally to counter Beijing’s influence on the Asian continent and in the Indian Ocean & the South China Sea.

India’s economic fundamentals are undeniably attractive and the geopolitical tensions provide a unique opportunity for the West to invite India to align itself under its umbrella.

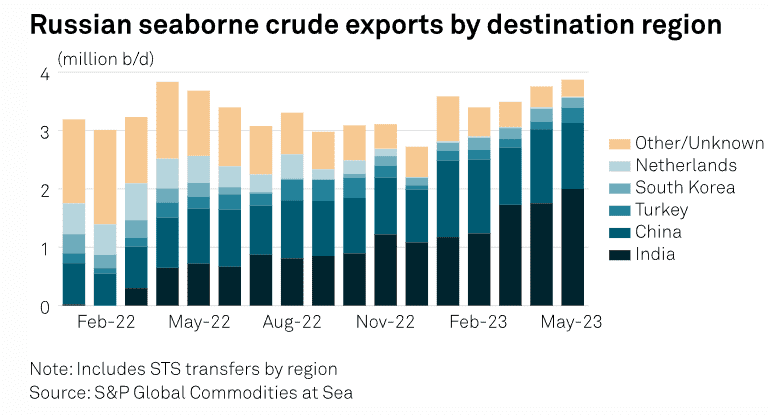

And how is New Delhi navigating the waters from its newfound position of strength? Besides standing up to China, they are playing the Russians and the West out against one another for Oil and capital:

Chart 1: Russian Seaborne Crude Destination

Find out our look on India and how we look at India investing-wise in a 14-day FREE trial below.

In this current cycle, India has emerged as a favorite among emerging market investors. But are we seeing a bubble similar to Japan in the 1980s? Or will India be successful in replicating the success of China? While we maintain a positive outlook – India counterintuitively is not cheap.

0 Comments