The full Ifo report just landed which means another quick Ifo Nugget with the most important charts from this month’s German activity numbers, which overall came in weak. Let’s dive into it.

The full Ifo report just landed which means another quick Ifo Nugget with the most important charts from this month’s German activity numbers, which overall came in weak. Let’s dive into it.

This week “5 Things We Watch” dives into the divergence between US and Europe inflation, OPEC continuing its cutting cycle, focus on shipping distortions in energy and Bitcoin boom.

Chinese equities with another strong session. Is it time to jump the bandwagon? Meanwhile, an expected non-event ECB meeting may not be completely sleepy.

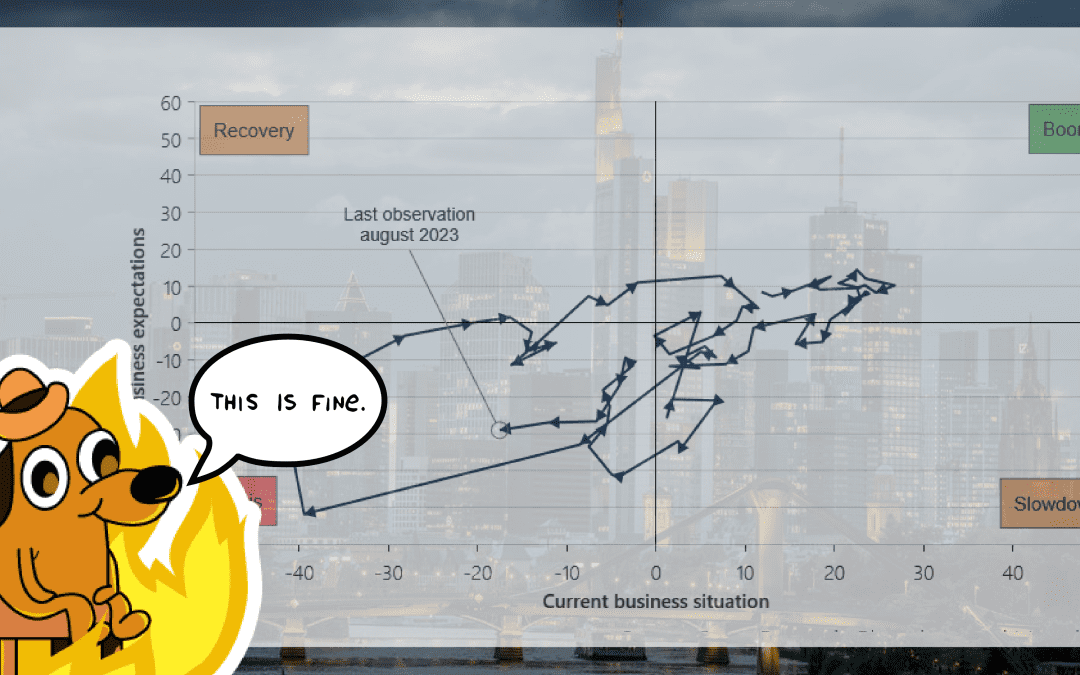

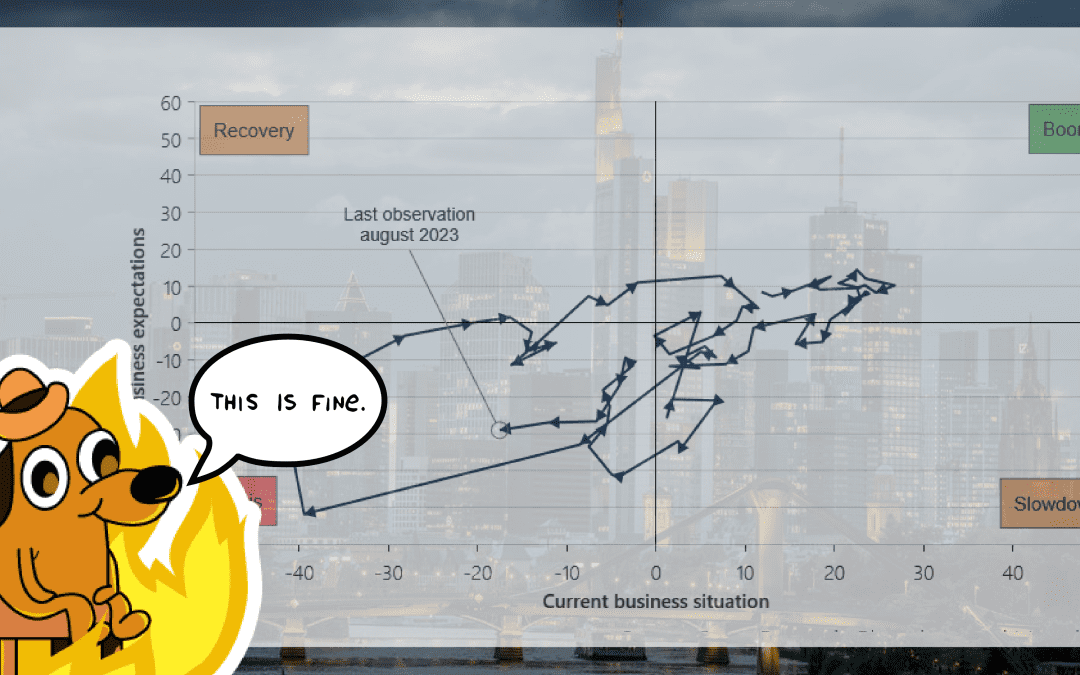

Today we got the full Ifo report which allows us to refresh our Ifo models and take the temperature of the German economy.

It’s Wednesday and that means time for another 5 things we watch where we hone in on the things that we have been most interested in over the last week.

There is no doubt left that the ECB has hiked for the last time, but the question is whether the doves can get the upper hand in the committee. Focus now shifts to the most important BoJ meeting in many years.

Markets are finally sensing that something is rotten in the economy. We have a look at what to stay on top of in the weeks to come.

With today’s release of the total Ifo data from the manufacturing sector we wanted to quickly touch upon the main data points we are looking at. We particularly note that good news in Germany, is now bad news for the EUR, since an uptick in the industry means more gas buying, which in turn means more FX outflow.

This week we had the anticipated German Ifo report come out in full, and while most parameters did not surprise, some might just be worth a closer inspection – an inspection we’ve decided to carry out

The doves are back after yesterday’s job openings data which signaled a labor market cooling off, allowing consensus to favor a pause in September. As always, there are plenty of things to dive into in this week’s edition.

The IFO Survey from Germany was a mixed bag of goodies but it emphasizes the trends seen lately. Germany is likely in a disinflationary recession already.

There are admittedly early signs that the Manufacturing sector rebounds in the US with the Dallas Fed PMI confirming the stabilization narrative. We tend to agree on the direction of travel in Manufacturing, but here is everything you need to watch outside of that sector.

Focus on cyclical indicators from Europe and the US this week while China is trying to prop up local assets again. Make or break time!

A brief nugget about today’s headline Ifo numbers. We’ll release an article about the full report next week.