5 Things We Watch – EUR Inflation, Ifo Survey, Swedish CRE, Deposit Flights & Nuclear/Uranium

It’s Wednesday once again, and that calls for us to have a look at the 5 things in global macro that we are looking at to stay on top of markets and everything related. Markets are as always having a hard time figuring out where the economy is heading, and some of the topics listed below will be of great importance to the future direction of all asset classes.

This week we are watching out for the following 5 topics within global macro:

- EUR Inflation

- Ifo

- CRE (Article on this soon)

- Deposit flights

- Nuclear

1) EUR Inflation

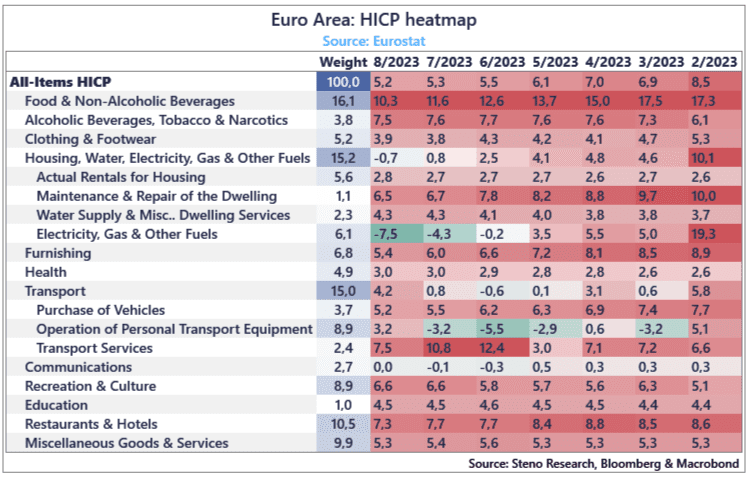

The preliminary inflation report for September will be released on Friday for the Eurozone, with expectations leaning towards another slowdown in inflation, expecting headline at 4.5% YoY, while Core expectations are a bit higher at 4.8%.

As energy disinflation is likely going to continue lower for some months to come before rebounding around November, and services disinflation is very much becoming a reality, a dovish surprise to Friday’s consensus comes at a great risk/reward in our view.

However, as energy inflation will rebound, so will a lot of the other components in the basket, implying broad-based inflationary pressures, and leaving the ECB with a tough job ahead of them, as YoY inflation is likely to increase as we approach the end of 23’. While a pause is likely to happen amidst all of this, we still don’t see a great risk/reward in betting on lower EUR rates / long EUR bonds. Instead, short EUR seems like the play as rising energy prices puts a downward pressure on the EUR.

Chart 1: Euro Area HICP heatmap

Markets are finally sensing that something is rotten in the economy. We have a look at what to stay on top of in the weeks to come.

0 Comments