Something for your Espresso: The ECB is done!

Morning from Europe!

The ECB meeting did indeed have dovish vibes tattooed all over it with clear consensus within the board of being at peak interest rates here.

The Doves even managed to sneak in a few hints here and there in the press release for the first time in over a year, which is a sign that they are BACK at the table after being left out of the discussion for several quarters in a row.

The wording on inflation was accordingly somewhat ambiguous in the ECB statement as it included a paragraph for the hawks and a paragraph for the doves

“The incoming information has broadly confirmed its previous assessment of the medium-term inflation outlook. Inflation is still expected to stay too high for too long, and domestic price pressures remain strong. At the same time, inflation dropped markedly in September, including due to strong base effects, and most measures of underlying inflation have continued to ease.”

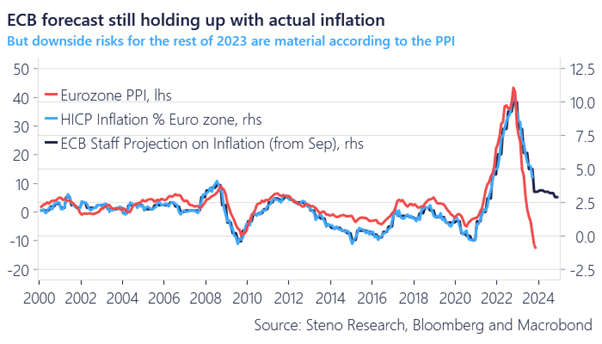

Both Doves and Hawks will likely be surprised on the low side on inflation numbers in Europe. See the below chart on PPIs versus HICP consumer inflation and the base-case from the ECB in September. We find it likely that Lagarde will be dancing to an even more dovish tune by December and cuts are on the table in Q1-2024.

Chart 1: The ECB is way too “hawkish” on inflation short-term

There is no doubt left that the ECB has hiked for the last time, but the question is whether the doves can get the upper hand in the committee. Focus now shifts to the most important BoJ meeting in many years.

0 Comments