Something for your Espresso: The one on Lagarde, Xi and their ilks

Morning from Europe!

We have seen another strong equity session in China and the market is so far celebrating the larger than usual cut to the reserve ratio requirements, which will inject liquidity into the Chinese financial system. The PBoC furthermore used strong rhetoric yesterday around a forthcoming material spike in credit growth during the first quarter.

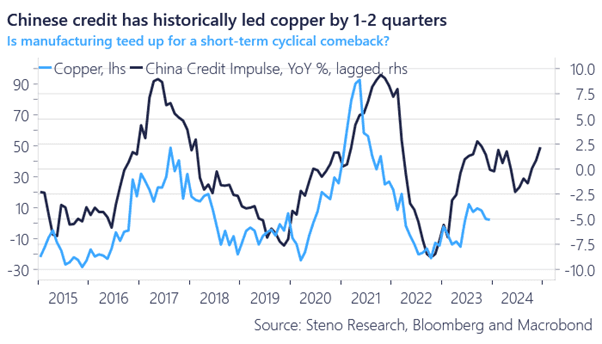

Is this another “cry wolf” event with future stimulus efforts falling short of expectations? We tend to think so over the medium-term, but the attempt to really prop up very short-term credit through the first quarter is hard to bet against. The most recent data suggests that credit grew by roughly 2.5% YoY in China, which is a clear improvement relative to mid-2023, and typically something that positively impacts China proxies such as Copper with a time-lag. Emil Møller released our EM by EM with more on the matter yesterday.

We are long Copper as a China proxy on a combo of:

1) A slight improvement in the Chinese credit and liquidity impulse

2) Light positioning (markets are net short)

3) Improving order/inventory ratios of Manufacturers globally

So far, so good!

Chart 1: A slightly improvement in Chinese credit is a positive sign for copper

Chinese equities with another strong session. Is it time to jump the bandwagon? Meanwhile, an expected non-event ECB meeting may not be completely sleepy.

0 Comments