Something for your Espresso: The cyclical litmus test

Morning from Europe.

We are on “Cyclicality Watch” this week with details from the IFO report released tomorrow, the ISM Manufacturing released on Friday and European price inflation released from Wednesday and onwards. China has released another playbook trying to prop up CNY asset values via State Banks. It seems like CCP is trying to turn matters into a “patriotic act” to buy local assets now, which is something we have seen in earlier cycles with limited luck.

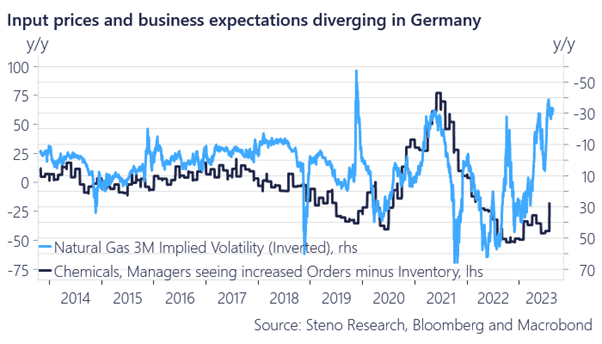

German IFO details will be extraordinarily interesting as the momentum in Euro area growth gauges look weak on the surface into Q3. We will watch 1) the orders to inventory ratios of highly cyclical sectors such as Chemicals and 2) Overall price trends.

We expect to see early signs of a cyclical pick-up via improving orders to inventories, as we have seen in the US since earlier in the year, but it will take another 3-4 months before it really shows up in activity.

Chart 1: Will IFO details reveal early green shoots?

Focus on cyclical indicators from Europe and the US this week while China is trying to prop up local assets again. Make or break time!

0 Comments