Positioning Watch: Who is caught in the Crossfire?

Happy Saturday, and welcome back to our weekly positioning watch, where we run through interest positioning insights/data collected throughout the week.

As we put pen to paper, history is unfolding in Israel, with plenty of shocking footage circulating online. With Netanyahu declaring war and a growing mobilization, it appears that the worst of the bloodshed may be yet to come. We will be closely monitoring the geopolitical implications in the upcoming week.

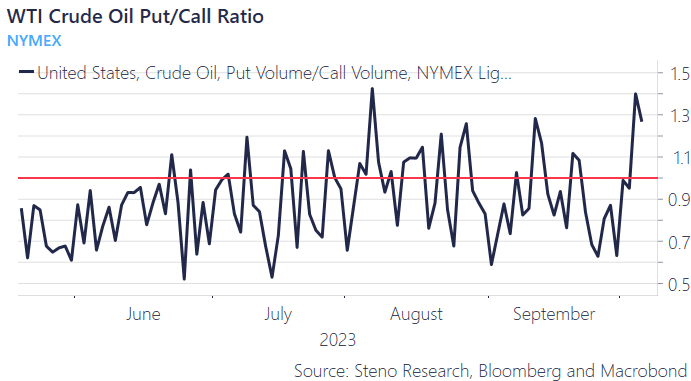

Now, shifting our focus to the financial markets, this week’s central narrative—up until today—has revolved around the EIA report and the subsequent significant sell-off in oil. Regular readers of our research might recall our previous questions about whether the EIA data report accurately reflected collapsing demand and whether the oil sell-off was excessive.

Looking ahead, we anticipate that the dynamics of oil pricing will become even more intricate in the coming months if geopolitical tensions persist, which, at the moment, seems highly likely. As we hinted at last week, the volume of oil contracts remains relatively low from a historical perspective, potentially creating an artificially inflated long interest.

However, this week’s price action is accompanied by a notable surge in the WTI Put/Call ratio. So, could we possibly expect short positions to face increased pressure in the coming week?

Chart 1: WTI Put/Call ratio

As we review the events of this eventful week, it unfortunately appears to conclude with a tragic development, as we find ourselves reporting on the potential beginning of yet another conflict.

0 Comments