Positioning Watch – Risk aversion is back?

The latter half of 2023 was all about the soft (perfect) landing narrative, which made markets party like there was no tomorrow. It almost looked like people forgot about risks, but positioning data has turned a bit at the end of December / start of January, which hints at a risk aversion comeback.

Could 2024 be the year when asset prices are no longer determined based on interest rates alone? It surely looks like markets have started worrying just a bit about the economy, crowded positioning etc., and we hence suspect usual asset correlations – which have been totally out of sync in 2021-2023 – to return.

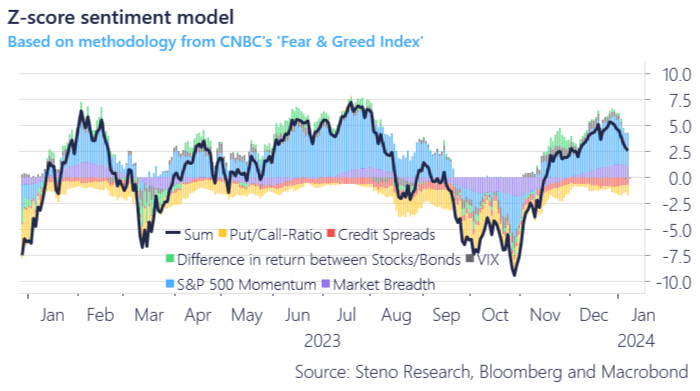

Our US equity sentiment model is slowly approaching neutral as momentum and market breadth look to have topped out, whilst outperformance in stocks vs bonds and VIX is not providing any more tailwinds for the Q4 rally. The setback in positioning gives some room for the increase in USD liquidity to work wonders, but it looks like price action will be more modest in 2024 compared to 2023.

Chart 1: A little setback in equity sentiment

Markets seem to have given up the perfect landing narrative, and the ultra-long positioning in bonds and equities has started to retrace. A more mixed 2024 upcoming?

0 Comments