Positioning Watch: Higher for longer vs Lower for longer?

Hello everyone, and welcome back to our weekly weekend Positioning Watch.

The Central Bank bonanza week has come to a close, with only a few localized surprises in policy decisions. It appears that only a handful of bold (or perhaps desperate) governors are willing to stand up to the market’s pressure these days.

Despite the markets being left with the same old “data dependency” mantra (e.g.: “we’re clueless and won’t commit to anything”), the Federal Reserve, at the very least, offered some guidance:

They anticipate that rates will remain higher for a longer duration than what the markets had been pricing in.

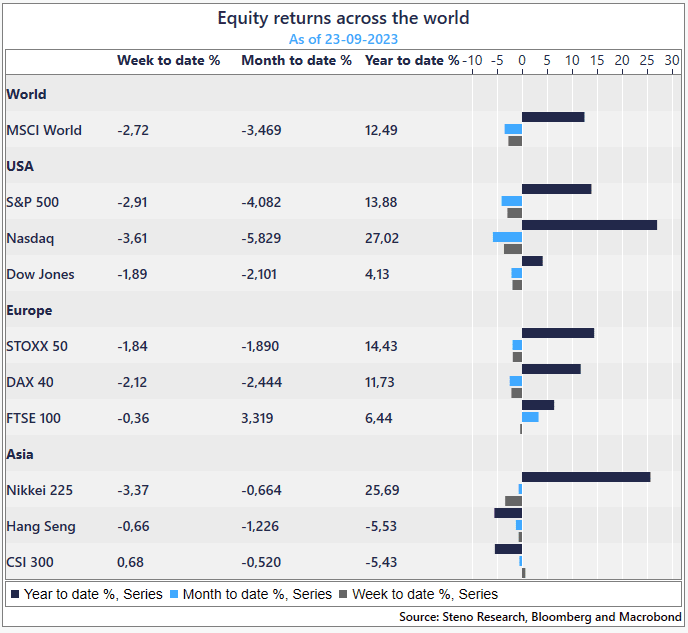

Consequently, we’ve witnessed significant selloffs as a result.

Chart 1: Equity Performance

The Fed projects higher rates for longer, while oil production cuts persist. How do markets play the “Higher for longer and Lower for longer” ? Read our weekly report below

0 Comments