Macro Regime Update June – Falling inflation in the limelight with wobbly liquidity

Welcome to our monthly update of our Macro Regime Indicator Model. Remember that you can always check the latest regime indication and back-test asset allocation strategies in each regime in our datahub right here.

Falling inflation is back in the limelight due to a range of soft forward-looking indicators, while liquidity “wobbles along” and remains above levels seen during the autumn of 2022.

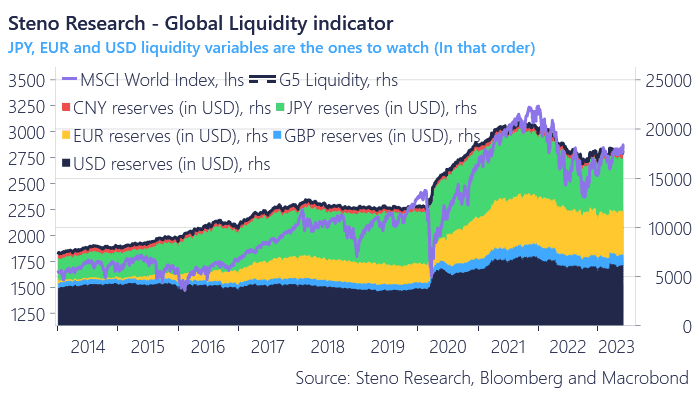

Global liquidity has held its course better than feared in 2023 and below you’ll find our brand new G5 liquidity indicator (the one in BBG is horse*beep*). A lot of pundits have been worked up over Chinese liquidity developments in 2023, but we have to remind you that Chinese liquidity is a drop in the ocean of digital reserves. USD, JPY and EUR liquidity developments are the ones to track (in that order).

Let’s have a look at the inflation and liquidity outlook in USD, JPY and EUR for June/July.

Chart 1: Global liquidity still above November-2022 lows

Our monthly update on our asset allocation framework is out. We track down liquidity, inflation, and growth in all major economies. Inflation is currently stealing the show as liquidity remains wobbly. Remain long the disinflation theme.

0 Comments