FX Watch: Everything that matters for EUR/USD is natural gas

We have been trying to trade the EURUSD on the short side a few times over the past 1-2 months with mixed results. Our fundamental story has been proven right but we have struggled to make money trading the relative weakness in Europe compared to the US in FX space. The bet has paid off in various other proxies such as the US equity superiority but not in FX.

It has made us ponder what the drivers are for the underlying positive flows in EUR/USD at a time when relative macro surprises clearly supported the long USD case from a fundamental standpoint.

Maybe the answer is much simpler than we had thought initially. Is the EUR case simply just driven by Natural Gas and nothing else? Most recent empirical studies suggest as much.

Let’s have a look at the data.

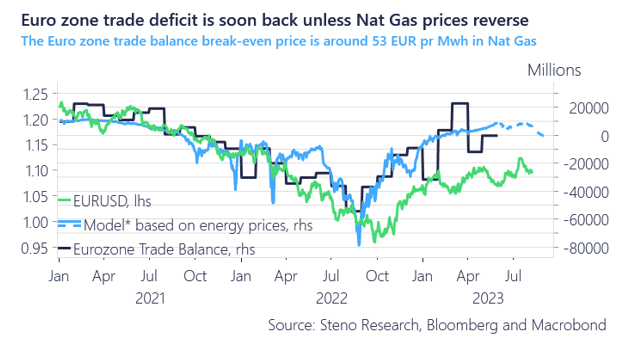

Chart 1: EUR/USD versus the trade balance (modeled by energy prices in light blue)

Is the EUR resilience basically just down to a continued decline in local energy costs? Natural Gas prices have explained almost the entire volatility in the EUR since 2021 and with the tide starting to turn in energy space, it may be time to watch out in FX space as well. Here is the data!

0 Comments