5 Things We Watch: Fed rhetoric, Chinese rebound, Chinese inventories, US labor market and a record-breaking yield curve inversion

Welcome to this week’s edition of the weekly recurring ‘5 things we watch’ series.

This week we have a particular focus on China, but that doesn’t mean we have taken the eyes off the ball in what else drives markets. In the US, Powell seems to be flip-flopping while China evidently plows on full steam ahead. Here, we have handpicked the five thematics which draw our attention the most:

This week we’ll try to unwrap the following 5 pressing questions captivating macro:

- Powell the flip-flopper

- The Chinese rebound

- Chinese inventories

- The US labor market

- The record-breaking yield curve inversion

Powell the flip-flopper

Yesterday (and today) Powell testified, and his remarks had somewhat different than recent connotations to it in regards to the path and pace of coming policy steps. The acclaimed data dependency and pertaining thereto rhetoric will always create excess volatility, not least because data has proven to be quite volatile itself (seasonal adjustments certainly added to that). Shopping from 50 to 25 to 50 and even 75 bps based on what has proven to be unreliable monthly numbers is a recipe for this volatility.

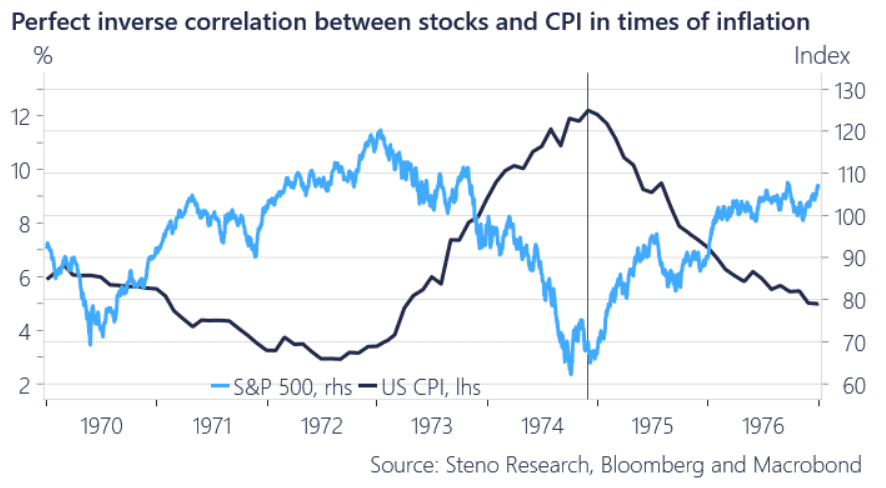

The re-pricing of Fed Funds path is continuous, and the market has been caught wrongfooted time and time again. Can the market absorb the return to 50 bps increments? In the end it really does come down to inflation. If tighter financial conditions is what it takes, then that will in the end be the lesser blow for markets relative to persistent inflation. We find that inflation risks are tilted to the downside short-term, which makes us less fearful of the Fed reaction function than the consensus.

For an extensive assessment on where inflation is headed, you can read our latest ‘Inflation Watch’ here.

Chart 1: Markets fuel on disinflation

Midweek has arrived and that calls for a rundown of the five things we watch the closest. As is the custom every Wednesday, we will take you through these most important themes (and charts) in macro and summarize how we interpret them.

0 Comments