Inflation Watch: Is the inflation momentum back before it even disappeared? 5 Pros and 5 Cons

“Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair.” Sam Ewing

It is quite obviously still too early to declare victory against inflation for global central banks even if they toured with a coordinated “inflation has peaked” message in February. In this Inflation Series, we will assess the risks of inflation resurfacing even before the first wave has truly waned. Is the double-top narrative warranted? Let’s look at the pros and cons of such a view.

This first piece will focus on US inflation trends, since we find US inflation to lead Europe by 5-6 months and Japan/APAC by 10-12 months. If something is boiling in the US, it will show up in the Rest of the World a little later.

What to watch in US CPI in coming months?

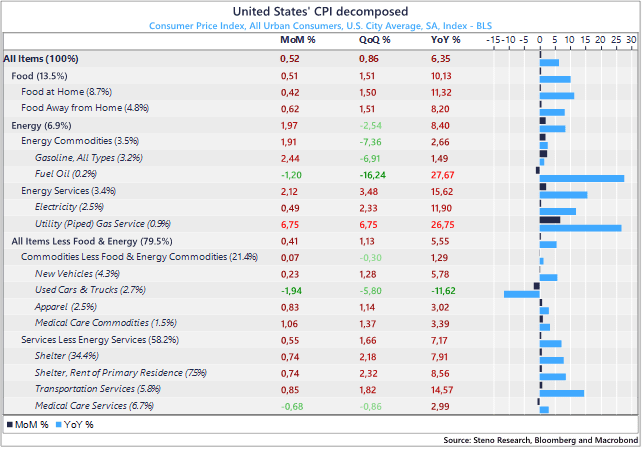

Let’s have a brief look at the cost categories to watch in coming months before we get to the pros and cons of the double-top inflation narrative.

We have our eyes set on four categories:

1) Energy prices. We know that week 10-12 will deliver some of the biggest energy base-effects seen in modern inflation history, which is the main reason to remain dovish on YoY headline inflation numbers over the course of the spring.

2) Shelter-costs are currently running at 0.7-0.8% a month, which is the swiftest rate of change of housing costs in the CPI in more than three decades. Shelter costs are running at a >80% percentile of actual monthly changes in rents, which make us believe that housing costs are going to wane from June/July and forward, which will prove to be a much-needed timing, if some of our leading indicators are right on inflation pressures in other categories.

3) Transportation services also run at 0.8% MoM and close to 15% annually. This was the major upset in the January inflation report and it is a category clearly linked to wage formation among blue collar workers. This is the biggest issue for the Fed currently.

4) Medical Services dropped 0.7% on the month in January after the biggest downwards seasonal revision in time-series history of the CPI. The PCE price index hinted of a larger price pressure in Medical Services and based on employment trends, a rapid decline is not on the cards in medical prices.

The disinflation trends are hence no longer as clear as they were during H2-2022. Let’s have a look at 5 pros and 5 cons of the inflation double-top narrative, which currently gathers momentum.

Chart 1: US CPI Inflation decomposed

Some early indicators of inflation have started to show worrisome signals 4-6 months down the road, which may lead to a resurfacing of inflation trends before the first battle is even won. Is the double-top inflation narrative warranted? Let’s have a look at pros and cons.

0 Comments