EM by EM #5 Stairs up and elevator down in China?

In my previous editorial on China, I accentuated the importance of taking Xi Jinping’s policy intentions seriously. However, given the challenges of navigating the complex Chinese market and the lack of favorable trade outcomes, it has become necessary for us to reassess our position.

In my even more recent watch piece I explained why I choose not to retreat from my overall thesis but rather acknowledge that the persistently negative flows out of China simply wears the position out. This risk was there, and I hoped sentiment would reverse as the hard data in the west deteriorated, but regrettably this risk did not yield any rewards, leading us to make the decision to close the spread trade. We can at least comfort ourselves with Michael Burry having made a similar bet simultaneously.

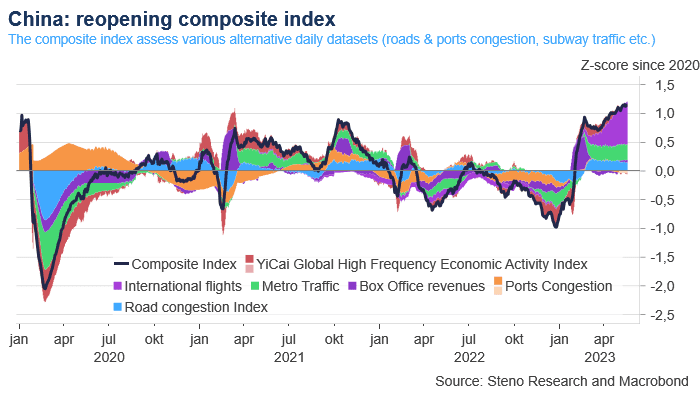

Instead of leaving all chips in the bank, we have taken another China trade rooted in our previous analysis – but let’s state the obvious first: While consumer stocks are not flying -the reopening is still in effect and our analysis still holds water in the present data:

Chart 1: China reopening

As the markets evolve, we adapt accordingly. Although the reopening of China’s economy is still ongoing, the optimism surrounding it is gradually diminishing. Simultaneously, the worsening economic data from Western countries indicate a significant slowdown. With the once-promising light at the end of the tunnel slowly fading away so do the flows. In this short piece we reveal our new position

0 Comments