EM by EM #34: Xi’s whip and Powell’s kneeling

As we move beyond the final Fed decision of the year, we can speculate on how the EM space may respond to Powell’s press conference tonight.

Before diving into that, let’s discuss some recent developments that have occurred in China since our last update on the situation in Beijing

While the market and all the mainstream news outlets have been awaiting the third plenum to take place in vain, China’s Central Economic Work Conference was held the past two days.

My 3 takeaways from reading translations from Xi’s speech and various state media statements plus various finance media reporting:

- Fiscal reform is in progress, with impending tax cuts to support innovation and manufacturing. (Note how the Third Plenum is still to be announced which could hint at major strategic differences in the policy elite which explains the conflicting statements from various policy officials in past quarters. Fiscal reform planning properly going to be a marathon)

- There’s a likelihood of increased support for the property sector, possibly to bridge it until new manufacturing industries mature. (Interestingly, there seems to be an increased prioritization of the development of shanty towns etc and emphasis on offering “working people housing”. I interpret it as increased worry about pass-through from the real estate sector as a whole. We remain pessimists until we see some major policy effort, right now the banks are told to increase their unsecured loans to homeowners/purchasers without much to show but increased risk to the financial system)

- Despite aiming for growth, China won’t employ potent fiscal or monetary policies; instead, the focus is on boosting confidence and shaping a positive narrative about the economy. ( Ironically, there is a clear implicit propaganda in the lack of policy efforts contrasted to the optimistic targets that do ring a bell from the rhetorical lead-up to the underwhelming stimulus package that we have received in 2023.)

These takeaways come after another weak data month from has been anything but positive.

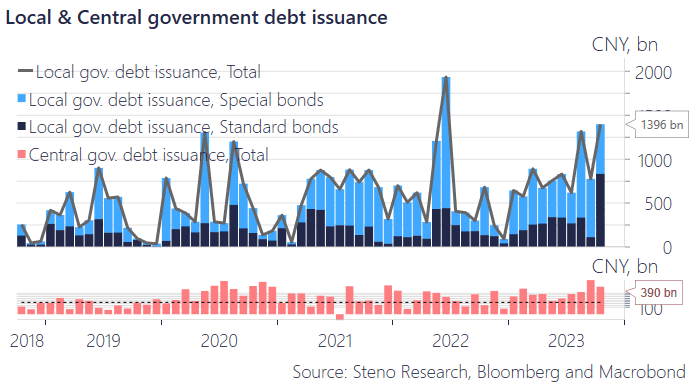

Chart 1: Public debt doing the bulk of the labour

After tonight’s press conference, any doubt about who is driving monetary policy should be dispelled. Powell appears to be allowing the market to dictate and is hesitant to provide significant guidance, in stark contrast to Xi and China, which seem somewhat immobilized yet hesitant to acknowledge reality

0 Comments