EM by EM #26: Biden, Blinken, Barrels & Beijing

It’s hard to overlook the remarkable resilience of the US economy and the current turbulence in global bond markets. When you add in the fiscal excesses and the elevated uncertainty in the trajectory of the oil market, it becomes clear that we are in quite a delicate situation.

Last week we did touch upon the situation in the Middle East, but what we haven’t delved into extensively in our latest EM-by-EM, is the dual interests of the US delegation, which is making desperate efforts to de-escalate the situation—albeit with limited success thus far. Notably, the US military base in Al-Tanf, Syria, has just come under attack though no reported casualties as of writing.

Biden has put forth an extensive funding plan to bolster ongoing war efforts, indicating that the White House is currently more preoccupied with the geopolitical situation than with maintaining fiscal sustainability domestically.

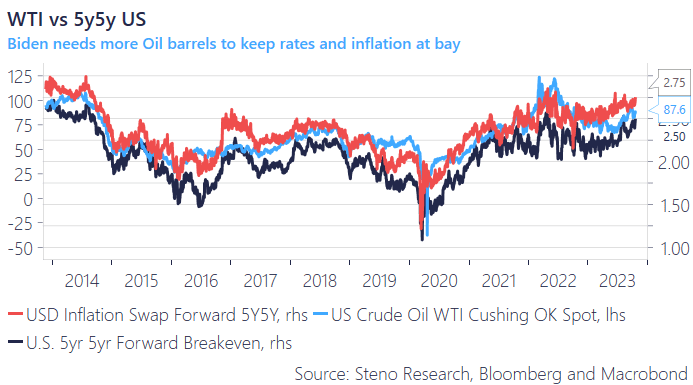

Consequently, the urgency of introducing additional oil into the global markets has never been more pronounced. If the Dems are to maintain their foreign policy objectives while keeping the electorate base happy, the prices at the pump need to go down, and ideally, without a recession

Chart 1: WTI vs 5y5y US

It is increasingly impossible to dissect what is going on in financial markets from what is taking place on the Geopolitical scene. Read below for our full take on the latest events

0 Comments