EM by EM #20 Another energy squeeze in the cards?

In our analysis last week, we delved into the situation in Turkey and arrived at the following conclusion:

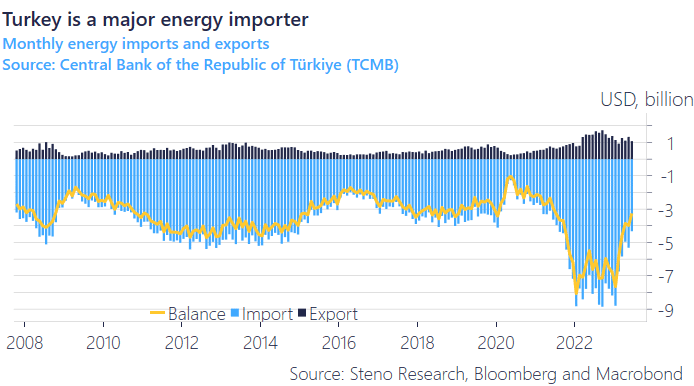

“The capable technocratic approach is more likely to succeed than the resurgence of economic populism. However, what currently deters us from fully engaging in this trade is the potential for inflationary pressures to escalate due to the harsh impact of energy price fluctuations, which can be particularly unforgiving for net-importing economies like Turkey.

That seems to have aged fairly well as Turkey’s CPI has since printed above expectations and Oil and Energy has continued its tear on the back of the Saudi production cut.

Chart 1: Turkey Energy balance

Sign up now for a FREE 14-day trial to access the entire article by clicking right here

Emerging market central banks demonstrated their foresight in 2021, acting ahead of the curve. However, there is a looming concern that the resurgence in energy prices might pose a challenge for them, much like it did in 2022.

0 Comments