EM by EM #19 The Simsek Effect kicking in?

When we last visited the Turkey case, rumors of Simsek’s potential return to office were surfacing as the markets grew increasingly restless due to the escalating economic challenges. Hyperinflation reached its climax in the autumn of 2022, propelled by soaring energy prices, while the reserves at the Bank of Turkey were rapidly dwindling creating a rather destabilizing cocktail for Erdogan’s administration

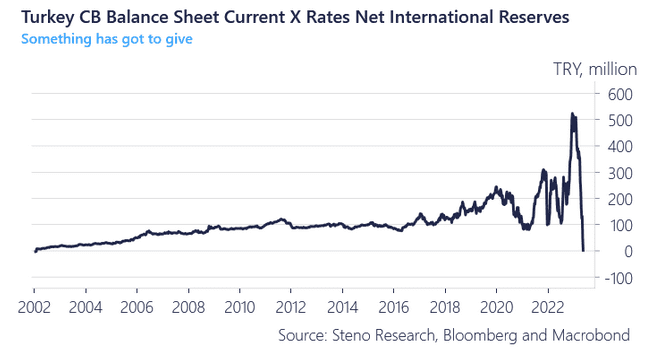

This was the state of the Net International Reserves on the first of June where our last Turkey piece was written. A lot has happened since and it makes us ponder whether the Turkish bet is getting interesting from a risk/reward perspective?

Chart 1: Turkey CBRT Net International Reserves, 1 of June

The Turkish central bank hiked the interest rates by 750 basis points against the market expectations of 200 bp underlying this month and both stocks & lira rallied on the back of it. Where is the Turkey case heading from here? Read our view here

0 Comments