5 Things We Watch – US CPI, Japan, Positioning, Fed Borrowing and Oil

Another Wednesday, another edition of 5 Things We Watch, where we run through 5 topics in global macro that we think are essential in order to determine your allocation and stay on top of the moves we are currently observing in global markets.

The big thing today is of course the CPI report, where markets expect headline inflation to drop to 3.1% since last year (mainly due to basis effects). We see an increasing chance that we will get a print BELOW the median survey expectations, which would send both equities and bonds further north. Meanwhile, the consensus bet is still underweight equities and long bonds, which would likely change should today’s print be more dovish than anticipated.

Interesting things are also going on in Japan on the back of this week’s surprising move in swap rates and the Yen, which outperformed the dollar for 5 consecutive days. Swap traders are now pricing in 10 bps more in the 10 yr curve than last week – does somebody know something that we don’t? We’ll look further into it, but for now, it seems like a short squeeze (at least for JPY).

To keep it short and sweet before the CPI print, let’s jump straight into it.

This week we are watching out for the following 5 topics within global macro:

- US CPI

- Japan (Article coming soon)

- Positioning

- Liquidity and bank funding

- Oil

1) US CPI

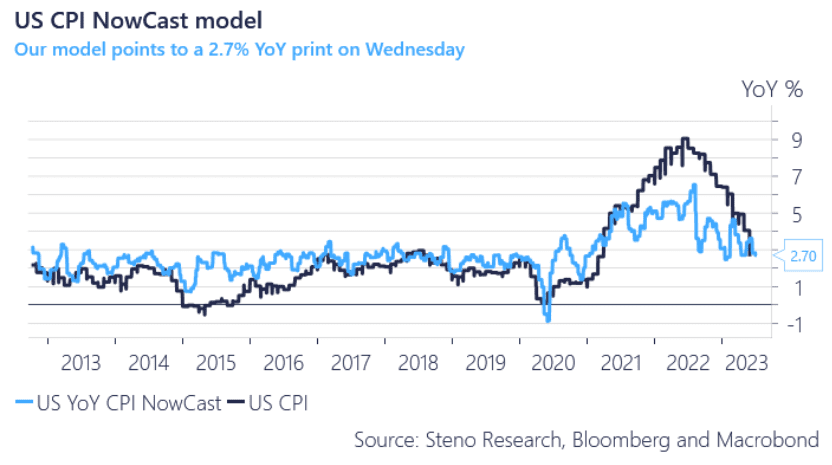

At 14.30 CET we’ll get a look into the possible rate hike path when the CPI report gets released. Headline is expected at 0.3% MoM / 3.1% YoY while core is expected to come in at 0.3 % MoM / 5.0 % YoY. However, even though headline inflation is expected to drop substantially, core CPI remains too high for comfort, and for the Fed to change its stance we’ll need to see much lower core prints – which will likely only come when services/employment (finally) weaken. The disinflationary trend will on the other hand be helped on its way by outright deflation in China – which will sooner or later be imported to the US.

We expect the number to surprise to the downside as almost every single indicator we are looking at points to waning inflation. And waning inflation might wrongfoot the consensus bet of being underweight equities as the landscape currently points to a soft landing on the surface (growing economy, slowing inflation).

Chart 1: Our model points to a 2.7% print today

With the US inflation report coming in later today, we have a look at the 5 things that we are keeping an eye out for in markets.

0 Comments