Bank Funding Watch: The lender of ‘favorite’ resort?

Welcome to this edition of the ‘Watch Series’ where we’ll have a closer look at the use of currently operational funding, credit, liquidity and loan facilities provided by the Fed to try and deduce the state of and outlook for the economy and financial markets – banks in particular.

Executive summary:

- Policy still poses a risk to the financial system

- Lending facilities have…

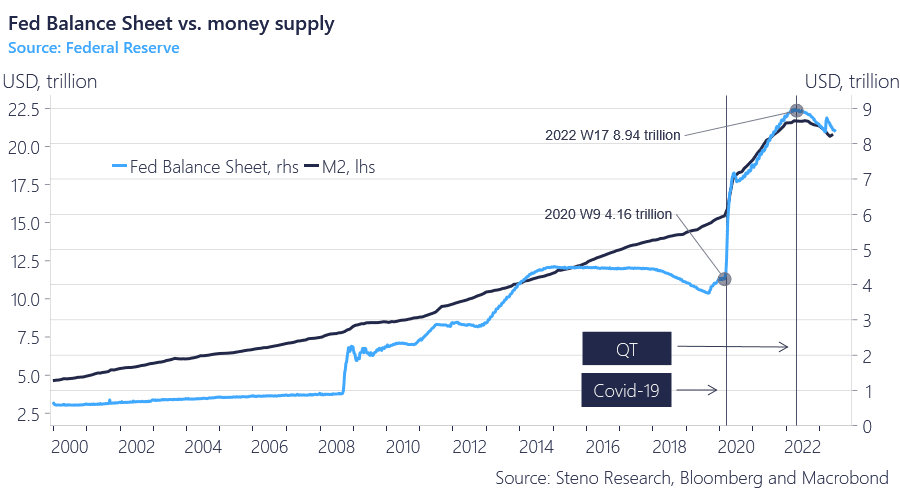

To ensure the functioning of the treasury and MBS markets in the immediate aftermath of patient zero, the Fed implemented lax monetary policy and resumed its QE. This OMO saw the Fed purchasing debt securities in massive amounts, resulting in more than a doubling of assets on their balance sheet ($4.2tn to $8.9tn). With the de-escalation of Covid and the emergence of inflation, they initiated QT with $95 bn of monthly tapering and raised the fed funds target which guides the offered SOFR O/N fixings, and we have since seen the most rapid ‘destruction’ of broad-based money in the financial system.

Chart 1: QE turned QT and its link to broad money supply

Emergency lending facilities provided by the Federal Reserve, and the BTFP in particular, relieved banks in distress and helped them stay afloat, but are the same risks still lurking or has the need for funding eased?

0 Comments