5 Things We Watch: Macro Regime, Oil, Manufacturing Cycle, Labor and The USD

Wednesday has arrived, and by now you know the drill. Once again we narrow down what’s currently on our radar to the 5 things we monitor the closest. As the banking turmoil has been backstopped – for now -, and the news is fading from headlines worldwide, we turn our focus elsewhere. From the current macro environment to the significant moves in oil prices to whether dollar strength is due. We’ll scratch the surface of these topics.

This week we’ll try to unwrap the following 5 pressing topics captivating macro:

- The macro regime – A QE-like environment

- Oil: Who’s got it right – Bulls or bears?

- The manufacturing cycle

- The (noisy) labor market

- The USD – Still a reserve currency

Let’s dive right in!

The macro regime – A QE-like environment

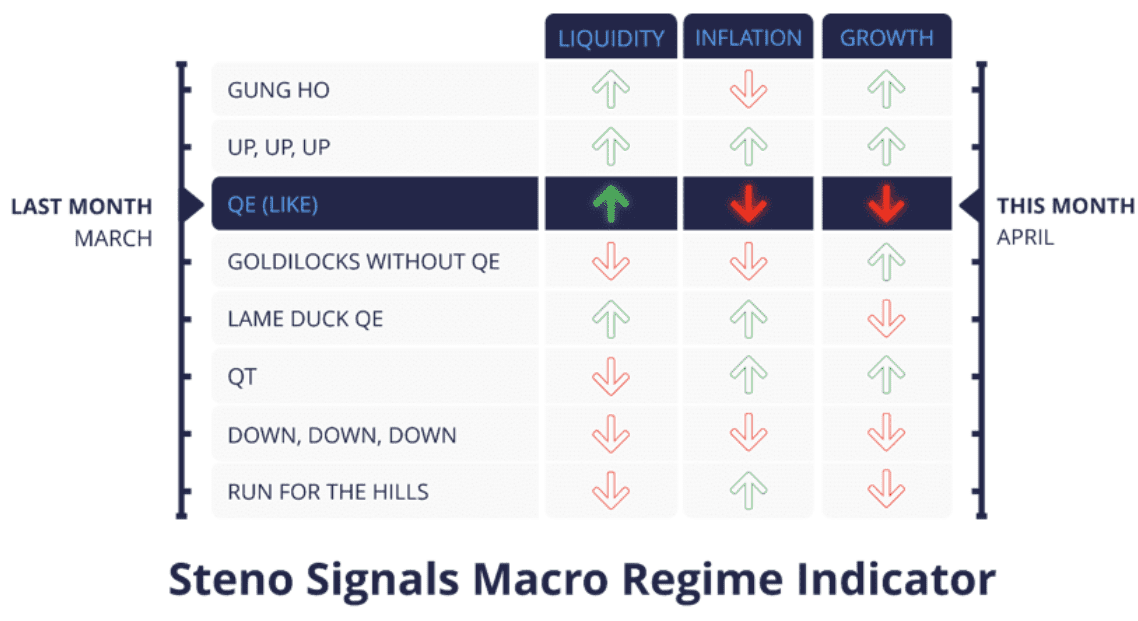

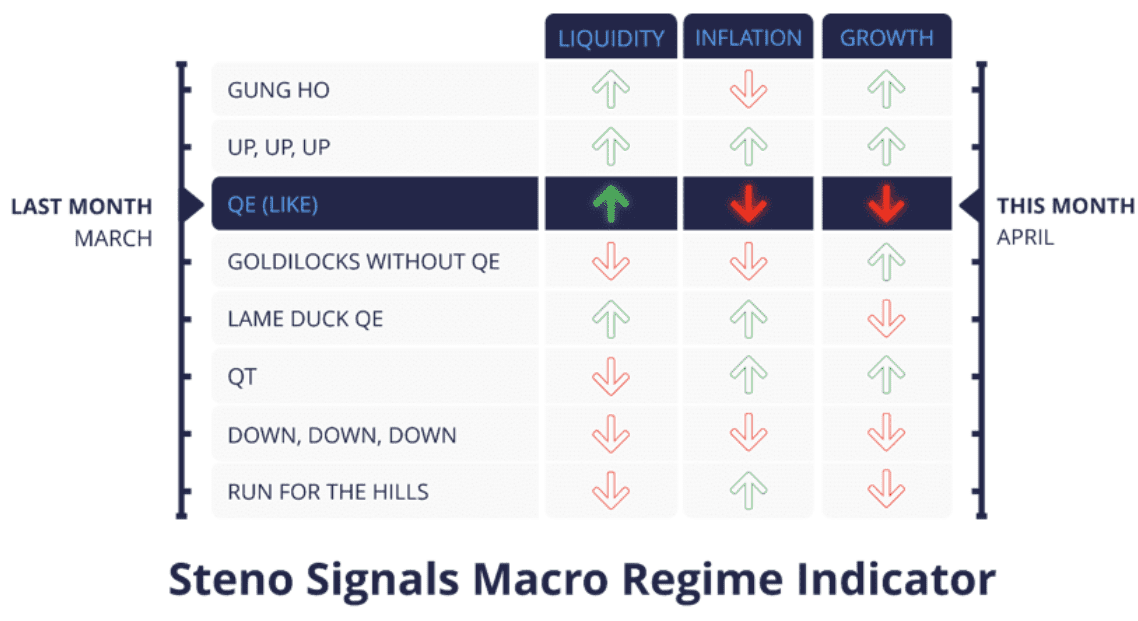

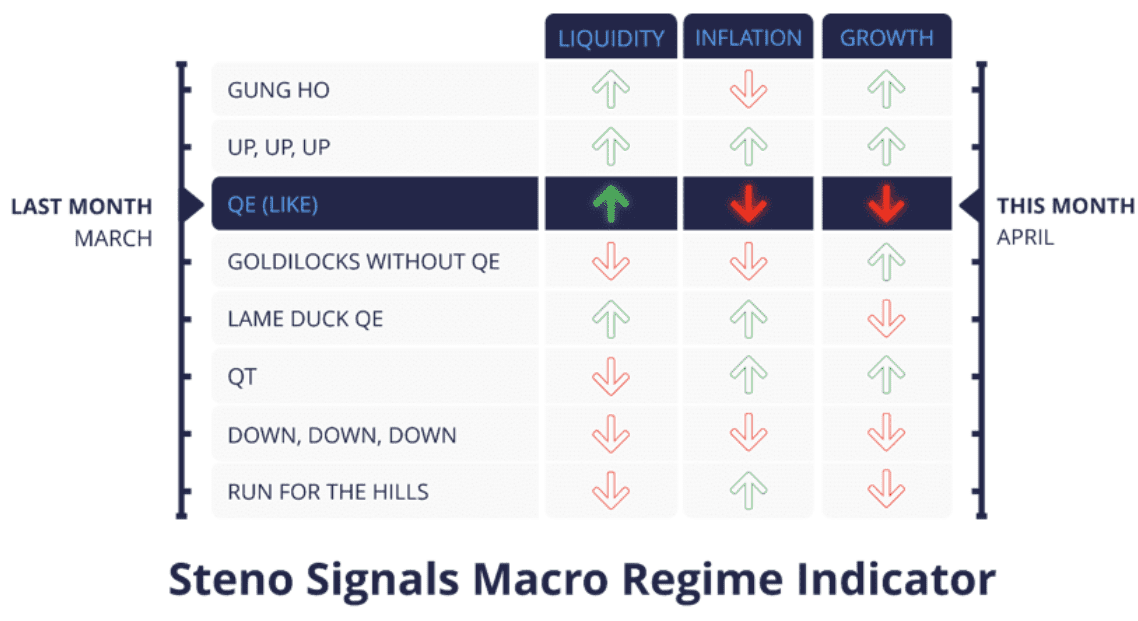

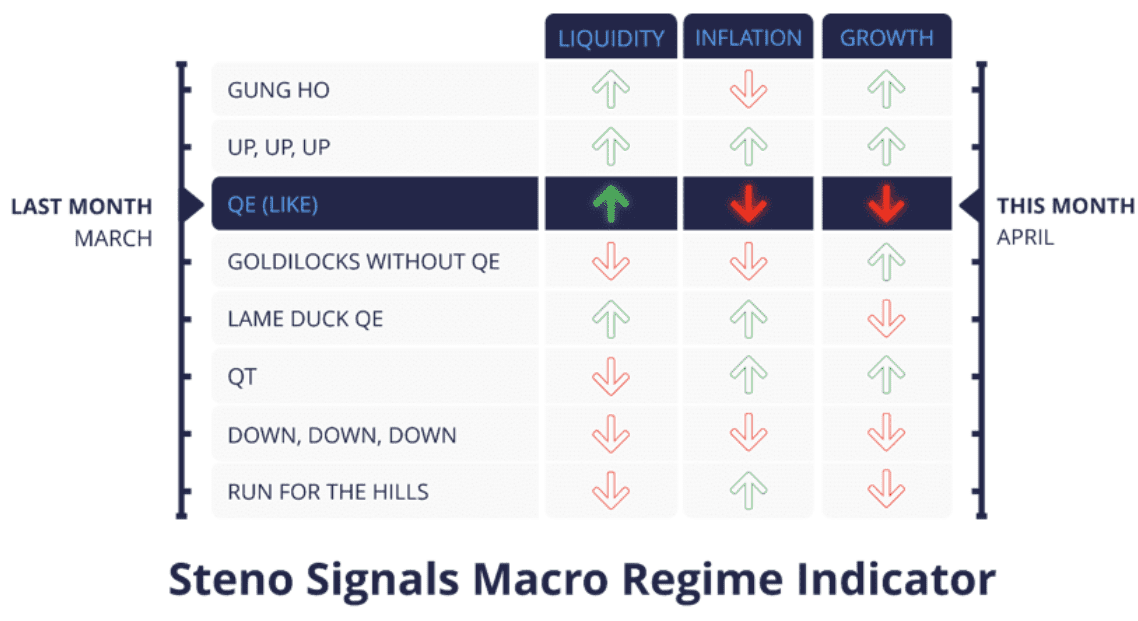

We update our Macro Regime Model every month to address the overall tactical aspects of asset allocation in a structured way. Last month we predicted a QE-like March with increasing liquidity but decreasing growth and inflation momentum.

Liquidity indeed increased through March, which was accelerated by bank failures leading to liquidity injections via lending programs. Growth declined marginally, while inflation decreased in year-on-year terms across the West through March.

Our projection is more of the same in April. Continued weakness in inflation and growth numbers paired with added liquidity. This is typically 1) positive for duration-intensive risk assets, 2) slightly positive for US Treasuries, 3) USD positive and 4) negative for commodities.

For our comprehensive account of the current economic environment, check out the full article on the matter. And while you’re at it, you should check out our entire back-tester of Macro Regimes in our newly launched Dashboard.

Chart 1: Not all that bad – for now

Wednesday has arrived, and by now you know the drill. Once again we narrow down what’s currently on our radar to the 5 things we monitor the closest. As the banking turmoil has been backstopped – for now -, and the news is fading from headlines worldwide, we turn our focus elsewhere. From the current macro environment to the significant moves in oil prices to whether dollar strength is due. We’ll scratch the surface of these topics.

This week we’ll try to unwrap the following 5 pressing topics captivating macro:

- The macro regime – A QE-like environment

- Oil: Who’s got it right – Bulls or bears?

- The manufacturing cycle

- The (noisy) labor market

- The USD – Still a reserve currency

Let’s dive right in!

The macro regime – A QE-like environment

We update our Macro Regime Model every month to address the overall tactical aspects of asset allocation in a structured way. Last month we predicted a QE-like March with increasing liquidity but decreasing growth and inflation momentum.

Liquidity indeed increased through March, which was accelerated by bank failures leading to liquidity injections via lending programs. Growth declined marginally, while inflation decreased in year-on-year terms across the West through March.

Our projection is more of the same in April. Continued weakness in inflation and growth numbers paired with added liquidity. This is typically 1) positive for duration-intensive risk assets, 2) slightly positive for US Treasuries, 3) USD positive and 4) negative for commodities.

For our comprehensive account of the current economic environment, check out the full article on the matter. And while you’re at it, you should check out our entire back-tester of Macro Regimes in our newly launched Dashboard.

Chart 1: Not all that bad – for now

Oil: Who’s got it right – Bulls or bears?

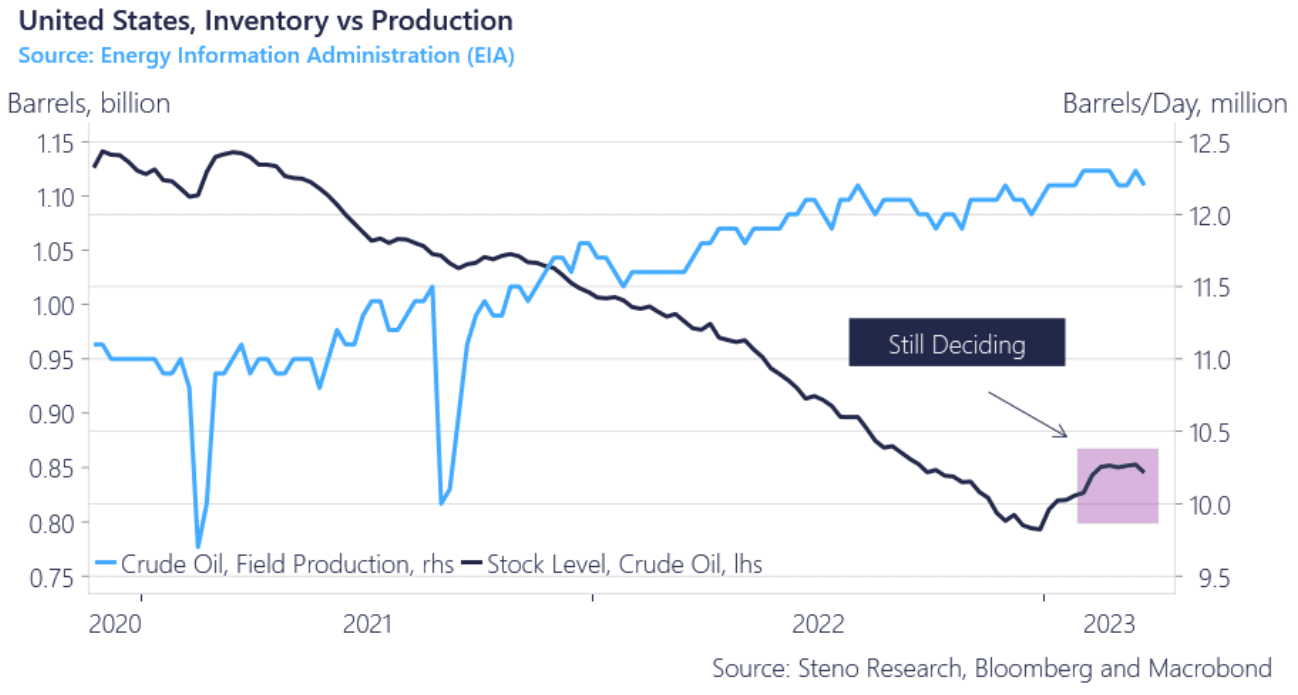

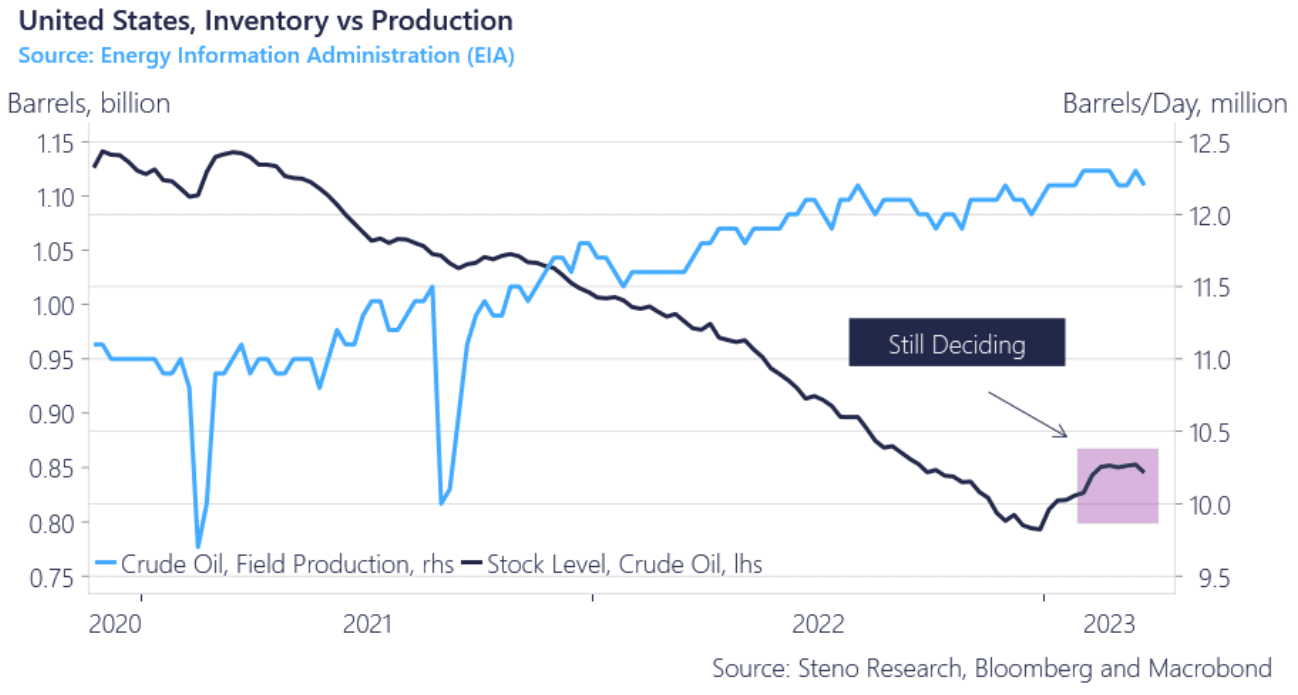

We also monitor the weekly release of oil inventory numbers as they have shown signs of weakness in recent weeks. The inventory increases seen in the early parts of the year were (partially) behind our bearish call on Energy and the balance of risks has clearly improved in the oil space in recent weeks. It no longer makes sense to be outright negative on Energy and today’s numbers are likely going to prove that point again.

Another bullish catalyst for oil, at least short-term, is the substantial production cuts announced by OPEC+ on Monday. Russia, Saudi Arabia, Iraq, the UAE, Kuwait as well as Kazakhstan have now cut supply in excess of a million barrels per day. On aggregate, the market will now be short 1.6 mn barrels/day.

The tight historic correlation between oil and economic activity is worth having in mind when analyzing oil. Our recession probability indicator is now pointing convincingly toward a recession primo H2 2023, and should the correlation hold, that would be a net negative for oil demand and hence price.

The picture is muddled, and we are at a point in time with loads of economic uncertainty, why we remain with one foot on the fence. Still, these days at least, bulls have the upper hand.

Yesterday we published the latest edition of ‘The Energy Cable’, in which we, in collaboration with Warren Pies, cover the matter in greater detail.

Chart 2: OPEC cuts tolling US stock levels (SPR)

The Manufacturing Cycle

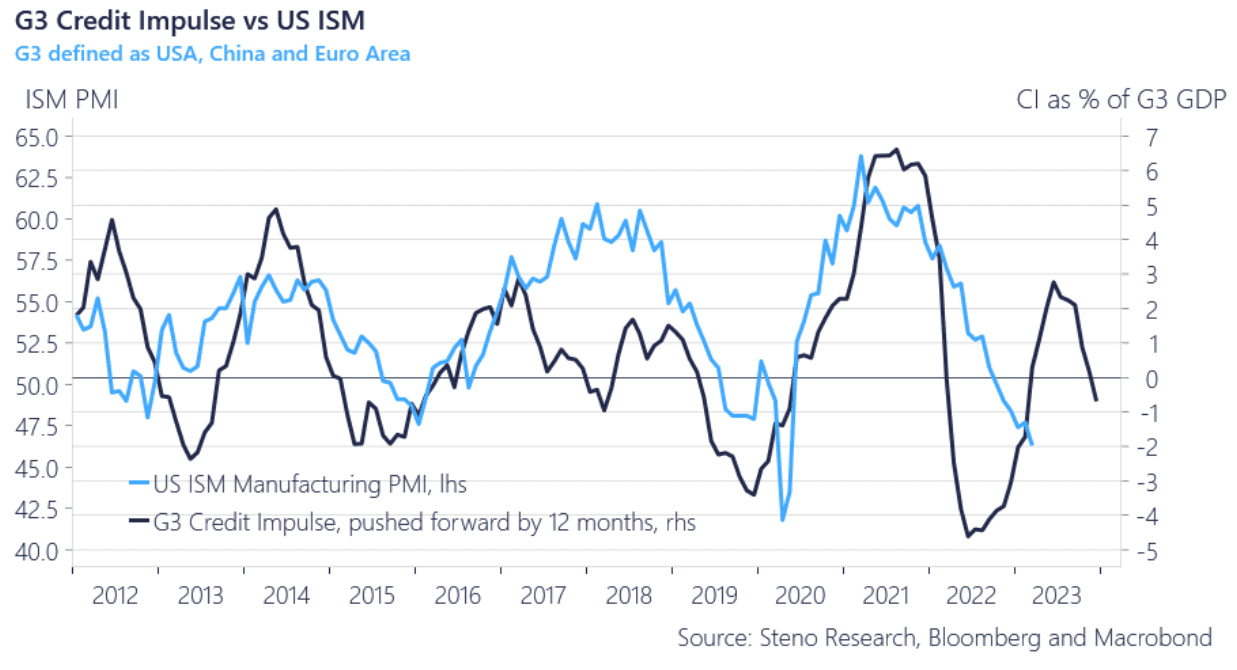

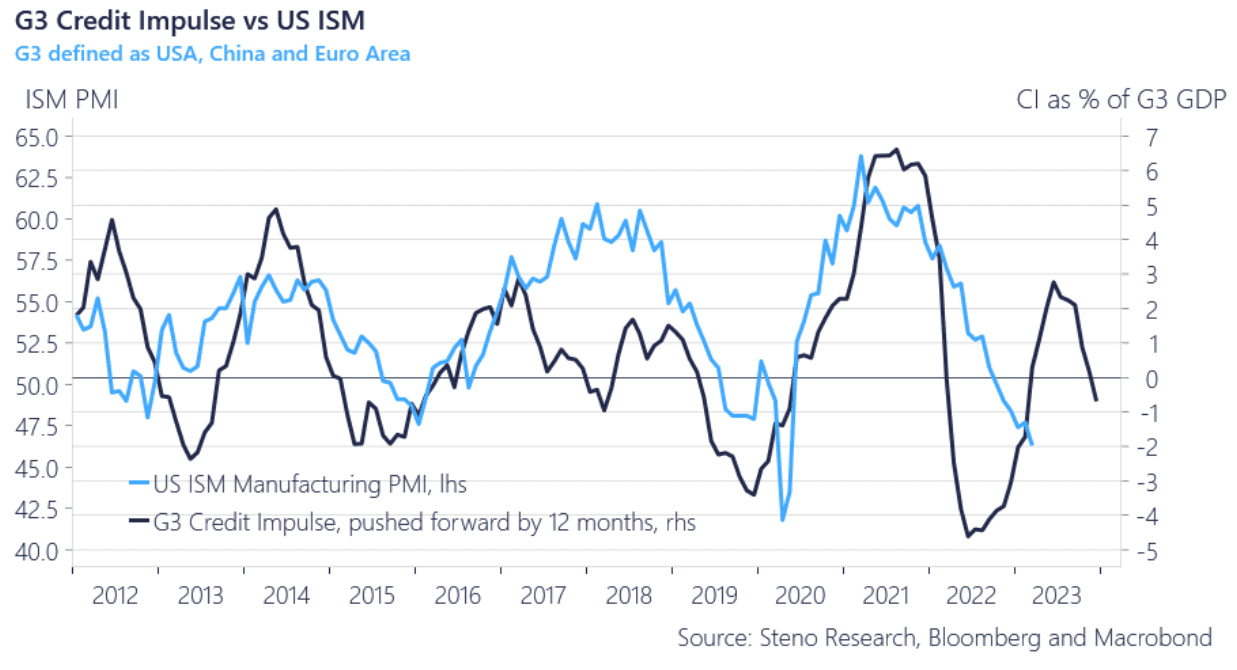

The ISM PMI is arguably THE gauge to observe to understand the condition of the economy – at least the manufacturing side of things, which is a massive driver of pretty much all else. The latest print was in ‘contractive’ territory (>50) but we expect to see a further leg down – albeit followed by a sharp rebound.

Held against the G3 credit impulse – credit circulating the economy – it too points to an impending downturn, but what we see as the major drivers of our conviction is the deferred but lagged effects from the steep rate inclines still ushering through the economy.

Paired with that, the discrepancy between new orders and storages adds to deceleration in manufacturing, but this is a balance we expect to realign fairly swiftly – especially fueled by the expectations of easier (emphasis on ..er) access to credit once again fuelling activity.

All things considered, we are very observant of a further deterioration in PMI’s from here but remain somewhat upbeat in the longer run.

Chart 3: Leg down before a sharp rebound

The (noisy) labor market

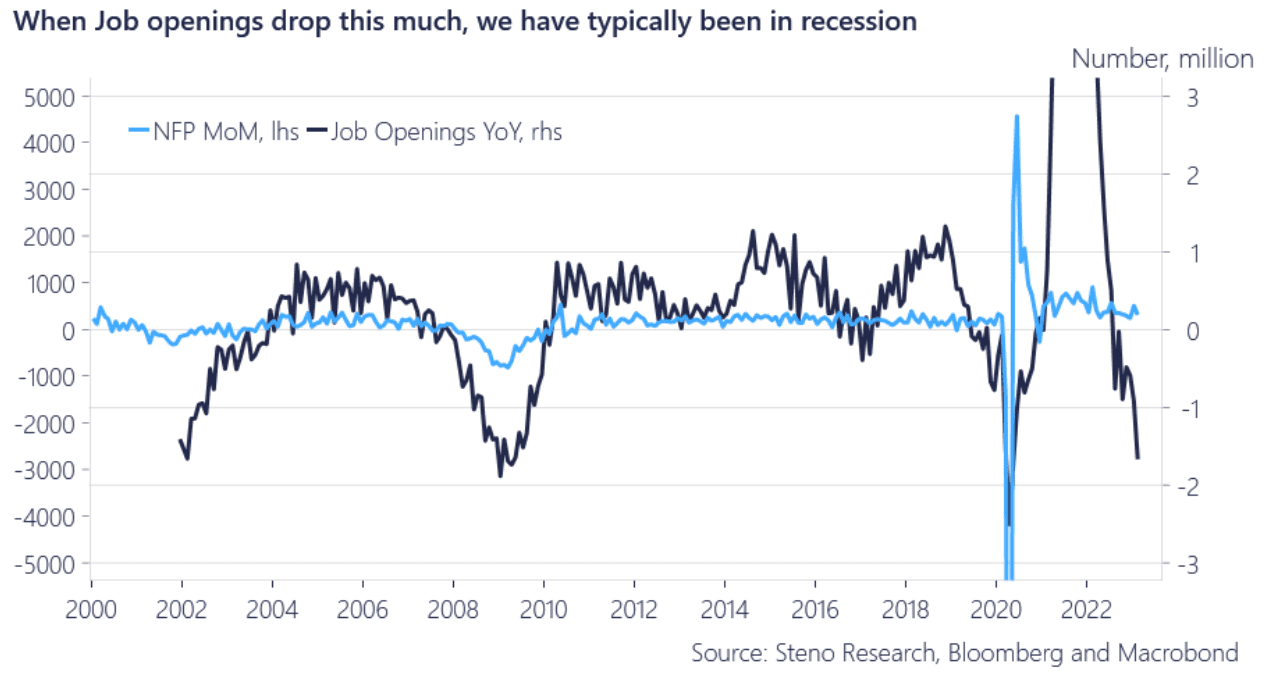

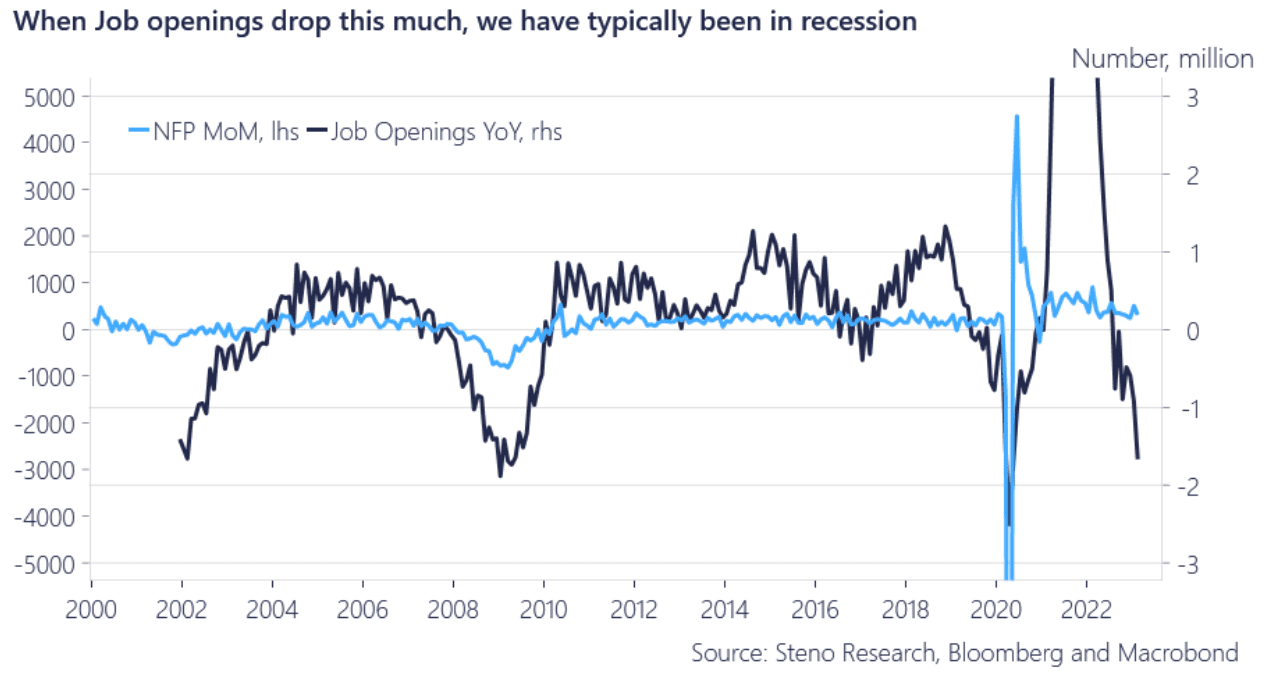

With the latest Jolts report, available positions totaled 9.93 mn, which was a drop of 632,000 from January’s number – a number that was downwardly revised. With a drop of 1.7mn openings since a year ago, it is very likely that the US is close to a recession – a view that our indicators are supporting.

Now, the question is whether the “elevated” level of openings is an important difference from previous cycles. What we can deduce is that, while remaining tight, the labor market is trending in a weaker direction.

Is the Jolts job openings report a bellwether for the coming Non-farm-payrolls print? Given the Fed’s dual mandate, of which the one is maximum employment, this could provide further room for coming cuts of the FFR.

Chart 4: Jolts a bellwether for NFP?

The USD – Still a reserve currency

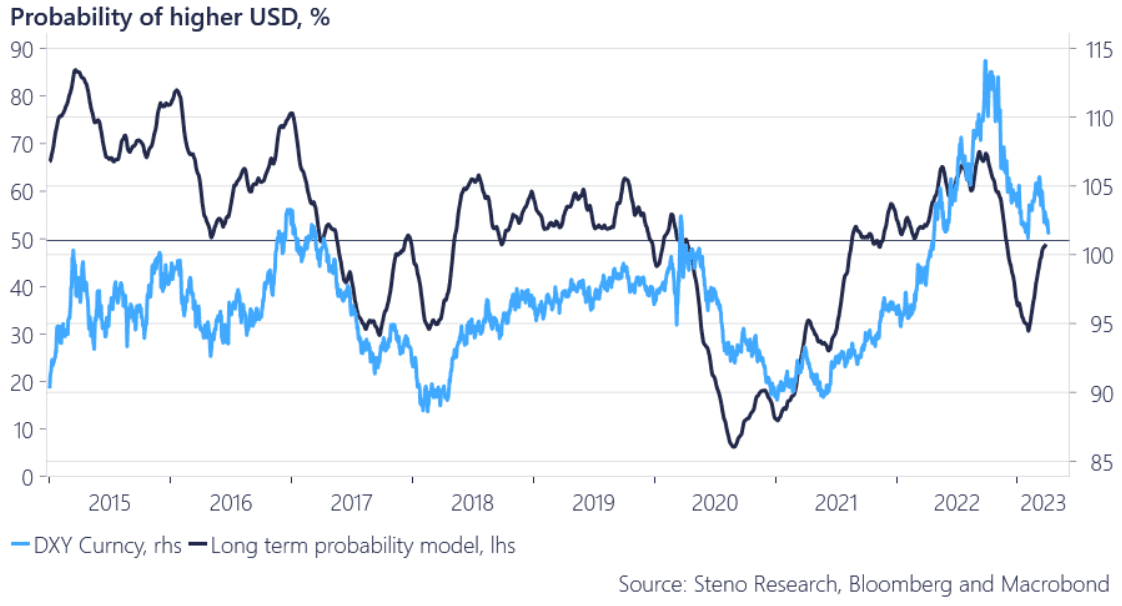

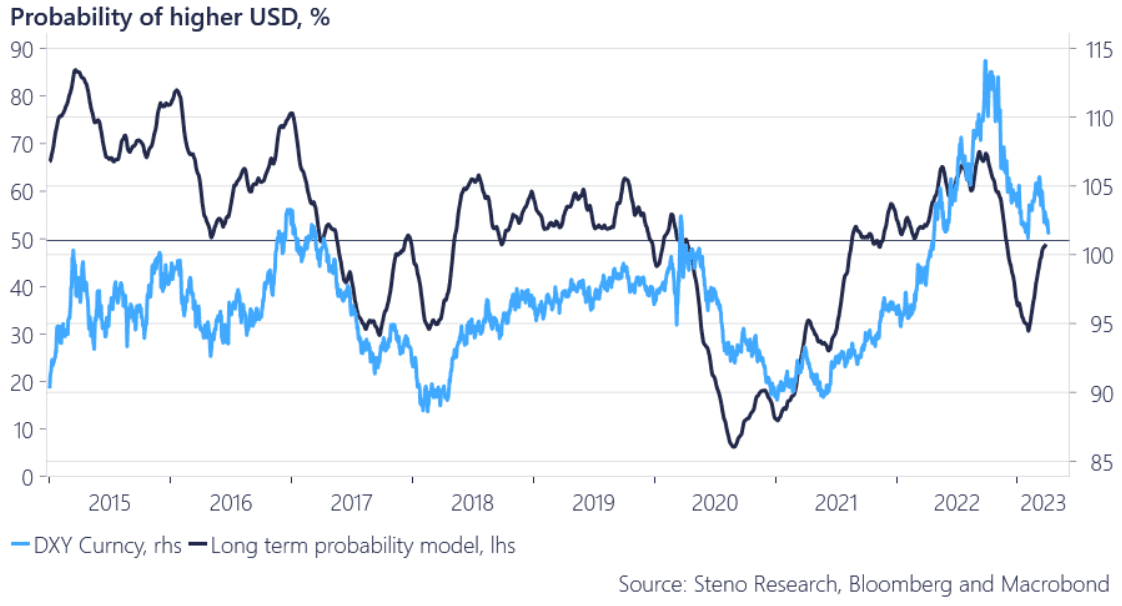

Despite our conviction of policy rate divergences being suppressed, our models start hinting of a stabilizing USD (50% prob of DXY upside), and from a trend perspective, it seems that relative strength could be on the horizon for the greenback.

The narrowing relative rate spread, and moreover the expectations of developments in that direction, has to a large extent been priced in by markets, and accordingly the dollar has shed off some strength. Trends tend to reverse when approaching extremes (acc. std. deviations), and thus, a reversal seems more and more likely – short-term speaking.

Pundits have thrown themselves over the story of other reserve currencies emerging to diminish the role of the USD. What we can, with enough confidence as to bet the house on it, is that the USD is in no fear of losing its essentiality as a reserve currency. A reserve currency needs to be highly liquid, investable and fully functioning underlying bond market. All parameters on which the USD/Treasuries remain unmatched.

Later today we’ll post the latest edition of our ‘Japan Watch’ in which the relative strength of the JPY/USD is put under scrutiny – so do stay tuned!

Chart 5: Some relief for the greenback?

2 Comments

How do you project monthly liquidity – for the U.S. inparticular?

I have a question how do I prepare my Stoploss when the Dollar has upside potential and I’m long JPY?

I mean if I short USDJPY and people get into Cash (Dollar). Or is there a potential that the DXY goes up but USDJPY falls.