Energy Cable #14 – A Fat Pitch is here

Last week, we made the case that an oil bull trade was on the horizon. Now, it appears the bull has arrived. Its length and duration are still yet to be determined, but, at this moment, all of the ingredients are in place for a powerful move higher in the price of oil.

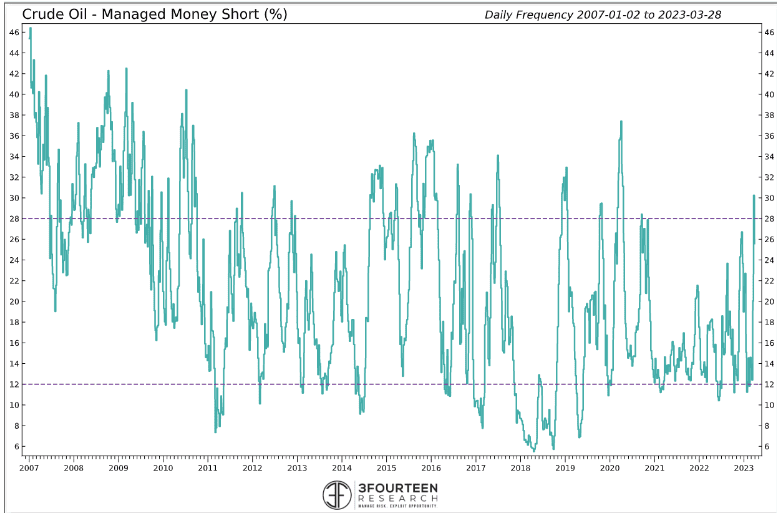

Let’s begin with positioning. Throughout 2023, positioning data has been volatile, delayed, and inaccurate at different times. It appears as though the CFTC corrected the issues just in time to give us the signal we need. To review, early in the year, speculators (defined as the Managed Money group in the CFTC’s COT report) had gotten long oil based on the China reopening theory. Then, the “banking crisis” hit and this group of hedge funds and CTAs decided to shoot first and ask questions later. Managed Money short positioning shot up to 30% (chart below).

With OPEC’s surprise cut of 1.15 mn. barrels, oil looks like a solid buy, meaning that the case from last week might turn out to be correct. But what about Natural Gas? Not quite the same story.

0 Comments