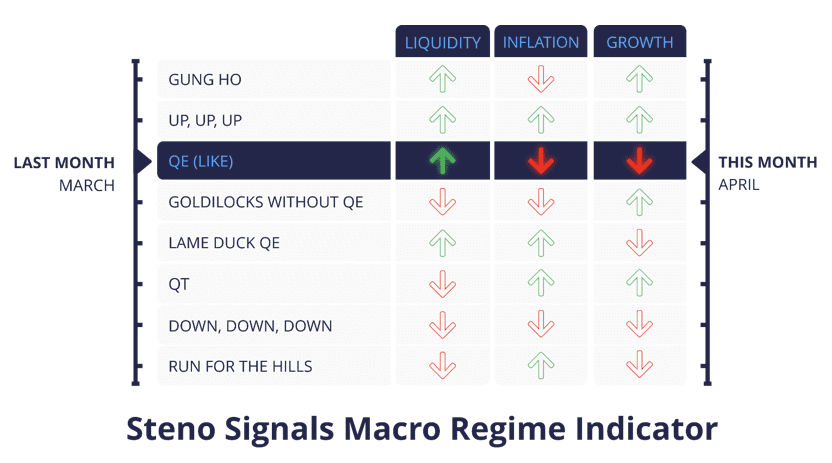

Macro Regime Model update: QE-like environment continues

We update our Macro Regime Model every month to address the overall tactical aspects of asset allocation in a structured way. Last month we predicted a QE-like March with increasing liquidity but decreasing growth and inflation momentum.

Liquidity indeed increased through March, which was accelerated by bank failures leading to liquidity injections via lending programs. Growth declined marginally, while inflation decreased in year-on-year terms across the West through March.

Our projection is more of the same in April. Continued weakness in inflation and growth numbers paired with added liquidity.

This is typically 1) positive for duration-intensive risk assets, 2) slightly positive for US Treasuries, 3) USD positive and 4) negative for commodities. Find the entire back-tester of Macro Regimes in our Dashboard for premium clients only here.

Chart 1: Steno Signals Macro Regime Indicator

Welcome to our monthly update of our Macro Regime Model, which provides a forward-looking guidance into tactical asset allocation. The “QE-like” environment that we predicted for March proved spot on, but partly for the wrong reasons. Will the QE-vibes continue?

0 Comments