5 Things We Watch – Governor panel discussion, EU Fragmentation, Riksbank, EU Banks & The EM rate cycle

Happy Wednesday everyone, and welcome back to our weekly series where we take you through the 5 things that we believe are a MUST to watch in the weeks to come.

The bull market (or bear rally depending on how you view the world) has finally been met by tailwinds following the hawkish remarks from Powell and the better-than-expected housing data. And apparently, it’s not only Powell who has the hawk-hat on, so does Norge’s bank who hiked 50bps, and Riksbank is coming with their interest rate decision tomorrow – will we see yet another 50bps increase? Our guess leans towards yes. On the other side of the globe, Ueda is not doing anything, and the BoJ keeps its neutral tone. Maybe that will change after today’s panel discussion? Follow along below to find our take on the 5 items listed below, as well as how we respond to them allocation-wise.

This week we are watching out for the following 5 topics within global macro:

- Governor panel discussion

- EU Fragmentation

- Riksbank

- EU Banks (Article coming soon)

- The EM rate cycle

1) Government panel discussion

At 2 PM local time (8.30 AM ET) today, Powell, Lagarde, Bailey and Ueda are kicking off a panel discussion to discuss the current path of monetary policy in developed markets, and we are looking out for any surprises in the wording used by J Pow given his recent hawkish remarks. The panel discussion is THE thing to watch today, and potentially a direction decider for intraday markets (and likely for the rest of the week).

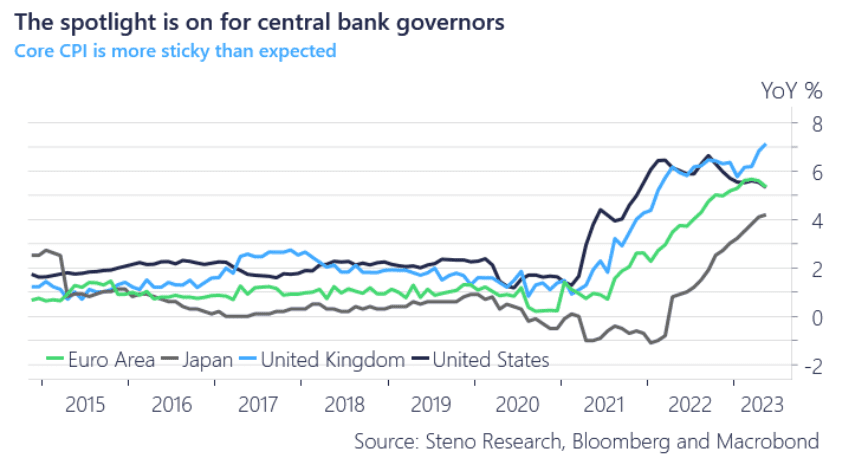

While we remain firm on the view that inflation is going to wane FAST during the next quarter or two, we acknowledge that services and especially housing is far stronger than anticipated, with housing prices ticking upwards almost everywhere in G7 countries, which will likely force Powell to convince his colleagues that a more hawkish tone is needed – he is after all likely the one who initiated the common central bank rhetoric throughout 2022.

Chart 1: A more hawkish direction might be appropriate to combat inflation

It’s Wednesday, and that calls for us to dissect 5 topics that we follow in Global Macro currently. What to expect from today’s panel discussion between governors? How is it going with the ongoing fragmentation of Europe? And will Riksbank hike 50bps like Norge’s bank? Find out here.

0 Comments