EUR Liquidity Watch – The ECB will have to punish governments more..

Welcome back to yet another piece on regulations, and the possible impact on markets. This week we are moving across the Atlantic to talk about Christine Lagarde and the ECB, who in the present year have put themselves in the driver’s seat (or so they thought) to preserve financial stability. The outlook for financial stability doesn’t look quite as they’d had hoped, however.

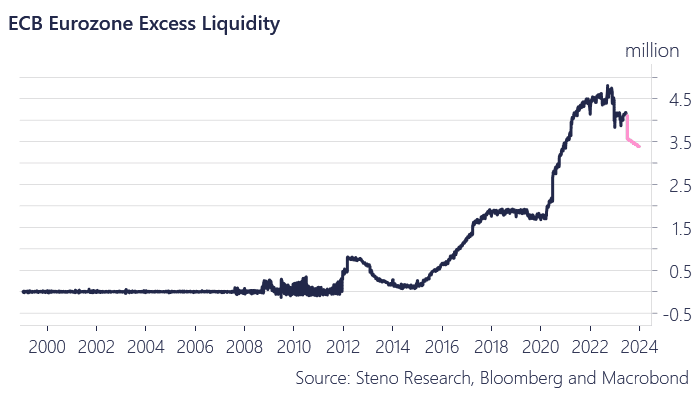

European banks are vulnerable, and they already struggle to intermediate large sums of excess liquidity according to the ECB, which will turn into a bigger issue when the ECB begins to withdraw 27-28 bn EUR per month when the APP will end in July. On top of that, TLTRO liquidity (approx. 500 bn. EUR from maturing loans and early repayment) will simply disappear this week, leaving the banking sector even more vulnerable.

However, the money received from maturing bonds and loans will roughly speaking just be deleted by a button in ECB, which will intensify the money destruction trend we already see – and substantially weaken the excess liquidity.

Read how it will impact European markets with a 14-day free trial below.

Chart 1: Excess liquidity will drop substantially

The ECB tries to incentivize governments to withdraw their funds from the ECB to mitigate a complete catastrophe when the QT race really begins at double speed from July and onwards. Will they succeed, and what will the ramifications be? Find out here.

0 Comments