Something for your Espresso: While we are waiting for Godot (and Inflation)

Morning from Europe.

Comments out of the ECB Forum in Sintra had a slightly more hawkish vibe to them than we had expected, but today’s panel discussion between Powell, Lagarde, Bailey and Ueda is likely the one to watch. The panel goes on stage at 2.30pm local time (8.30am ET) and especially Powell’s take on the latest patch of hawkish readjustments to central bank policy paths around G10 will be interesting.

Powell was likely the main man behind orchestrating the coordinated wording on an inflation peak and the wish to assess the lags with which monetary policy works across most major central banks.

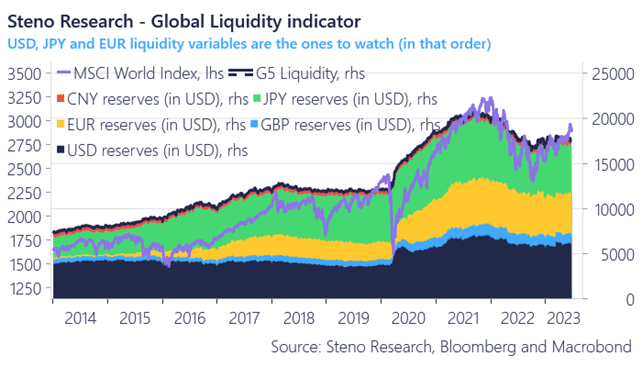

Global liquidity still fares better than feared, but EUR liquidity is on the verge of declining sharply by over EUR500bn by the end of the week. We note how the ECB must do more to persuade governments to alleviate some of the liquidity constraints via drawing down on depos. More in our Watch series from yesterday.

Chart 1: Global liquidity holding up decently so far..

Risk appetite is back in markets while we wait for June inflation numbers in Europe. The big panel discussion at the Sintra conference will be closely watched today.

0 Comments