USD’o’meter: Is King USD about to reverse?

In this piece, we will try to assess the USD outlook in a structured way by looking at:

1) Relative rates

2) Relative inflation

3) Relative Growth

4) Relative energy

We combine the four filters in an aggregate probability-based model and find that the USD is still likely to increase in value for the next few months.

Let’s have a look at the details.

Relative rates:

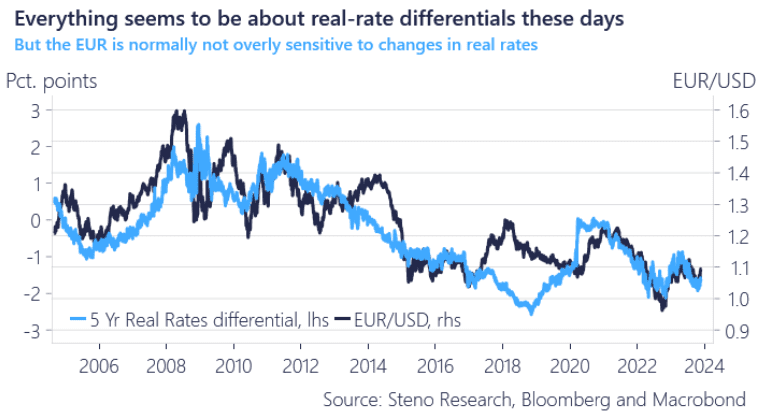

Real rates have moved slightly in favor of the EUR since the last FOMC meeting but not to the same extent as in e.g. JPY versus USD.

If anything, EUR/USD has front-runned/extrapolated the recent USD real rates weakness, which could be wrongfooted if we are right on the strong seasonality in US key figures until year-end. If they accept a Fed-style FCI-based reaction function in Europe, the ECB has (much) more dovish work to do in 2024 compared to the Fed.

Relative rates bottom-line:

EURUSD trades on the high side of fair values

Chart 1: Real rates versus EUR/USD

The soft inflation report from the US led to a substantial sell-off in the USD alongside weaker real rates, but is the tide turning for the USD? Our models are not convinced yet.

0 Comments