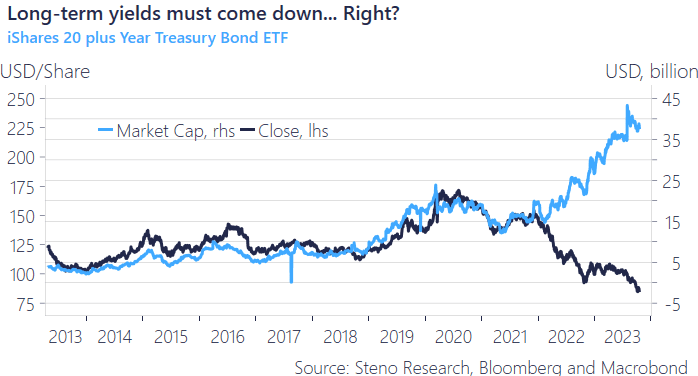

US Treasury Watch: An opportunity of a decade or still the pain trade?

Some much-needed bids provided relief to the bedrock treasury market last week, and yields eased off a bit. The relief was short-lived though, and this week’s yields continue its climb. But, is now a golden opportunity for buying bonds, or is the cocktail of vast issuance, some CBs unwinding their holdings, and still poor appetite bound to send yields even higher? Opinions out there diverge.

And what about the flip side of the yields-equation? Spreads have supported the USD against nearly every other currency, but the question remains whether momentum and fundamentals will continue to.

We’ve looked for clues and correlations…

With offered yields at decade highs, we see windows of opportunity in bonds. Albeit, with upside risk to inflation, a (continued) cyclical upswing, and NFIB price plans hinting at median CPI well above 2%, we are confident in another hike, and – unless something caves – a high(er) for longer scenario.

While the abstract ‘neutral’ has arguably turned out to be higher, we believe that yields are restrictive currently and eventually must come down. Rather than catching a falling knife, we see a sufficient opportunity to get in with greater confirmation later on.

Chart 1: Markets have been crying wolf for almost two years

To access the complete article, subscribe with a 14-day FREE trial using this link

Treasuries have tumbled as 10- and 30-year yields touched their highest in 16 years. Meanwhile, the US Dollar keeps steaming ahead. Is now a golden opportunity for buying bonds or will supply surmount demand, and can the USD extend its streak of strength?

0 Comments