The Energy Cable #36 – Will we finally see Chinese demand with the new stimulus?

In this edition of your maverick energy/commodity newsletter from both sides of the pond, we discuss whether the Chinese stimulus will finally see demand picking up markedly in China and whether this could lead to Energy becoming THE consensus bet again.

Let’s dive right in!

Steno Research: The BRICS impact on commodity markets

Metals continued their upward momentum last week, benefiting from positive sentiment in China’s property and manufacturing sectors. On Thursday, Beijing took steps to stimulate the housing market by allowing major cities to reduce down-payment requirements for homebuyers and encouraging lenders to lower mortgage rates. Additionally, on Friday, the Caixin manufacturing index for August unexpectedly returned to expansion territory. This morning the Services sector did not play ball, but that is typically not a direct issue for the energy sector/demand.

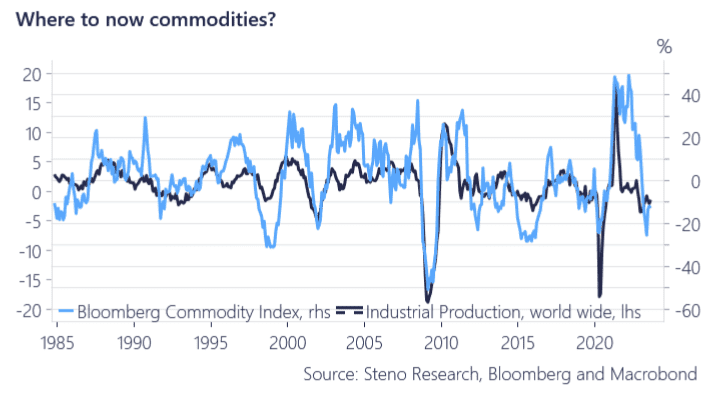

These developments have bolstered optimism in the industrial commodities market as investors assess the effectiveness of Beijing’s targeted measures to counteract an economic slowdown. Up until now commodities, especially energy, have seen their gains come from supply-side squeezes (OPEC + cuts, labor strikes, and Greenflation just to name a few), but with the expected rise in Chinese demand, things could get spicy. Take copper which is expected to remain volatile at elevated levels as traders anticipate government stimulus measures. Citic Futures Co. stated that low copper inventories pose a risk of supply shortages. Something we too have covered- see here

Earlier in the week, China’s official manufacturing gauge showed signs of improvement, indicating only a slight contraction. Furthermore, on Friday, China announced initiatives to support its currency, which had slid to its weakest level since 2007 in August.

Now, before we all get too excited, let’s just rewind the clock 6-7 months when everybody and their mother were uber bullish on the Chinese reopening story, which (As we warned about here in Energy Cable) never got going.

Chart 1: Time for some life into the demand side of commodities?

The Chinese stimulus measures presented last week could provide generalists with another reason to jump the Energy bull train. Does this mean that the energy optimism is close to peak?

0 Comments